Gogo: A Local, Stable, Convertible Means of Exchange

Questions and Answers about the Gogo

About the Designer of the Gogo

The Gogo is a local, stable and convertible means of exchange, and is designed to be and to do what the Canadian Dollar is not, and can not. Read on and you will learn the differences.

Circulation of the Gogo is limited to the area of Grand Forks in southern British Columbia, Canada. Other communities can have their own Gogos if they like.

The value of the Gogo is based on the value of the Canadian Dollar in 1980, and is forever stable at that level. This means that prices in the Gogo will never change.

The Gogo is convertible with the Canadian Dollar, based on the Consumer Price Index at the time of the exchange. For example, in 2001, 1 Gogo costs $2.20 Canadian, which reflects the decline in value of the Canadian Dollar of 2001, related to the value of the Canadian Dollar in 1980. You can figure this out yourself by acquiring a copy of the Canadian Consumer Price Index and calculating the decline in value of the Canadian Dollar over time.

The Gogo is a means of exchange, it is not a store of value. It is therefore designed to circulate. To encourage this, there is a 5% charge, applied on a yearly basis, on the Gogo. This 5% covers the cost of printing the currency and other expenses associated with managing the Gogo properly. Any excess will be returned to the community of Grand Forks.

----

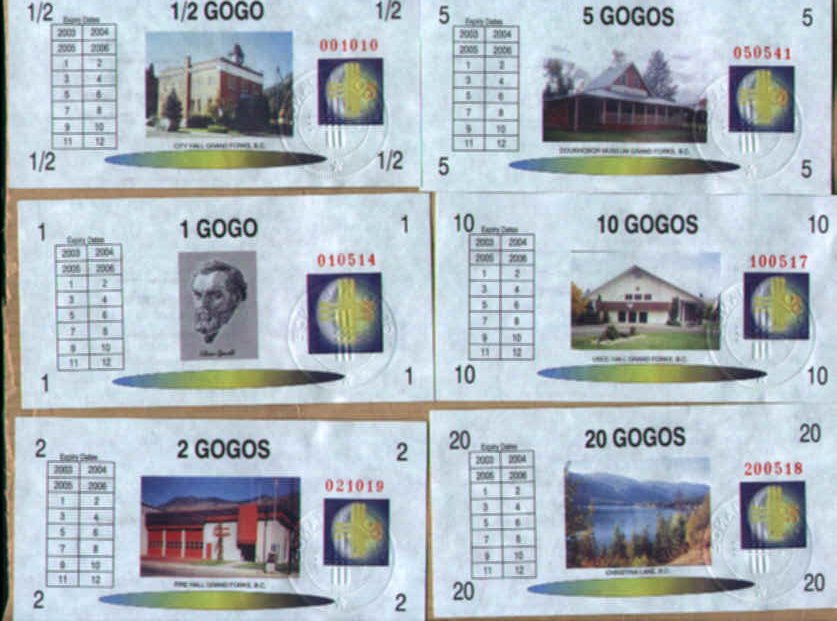

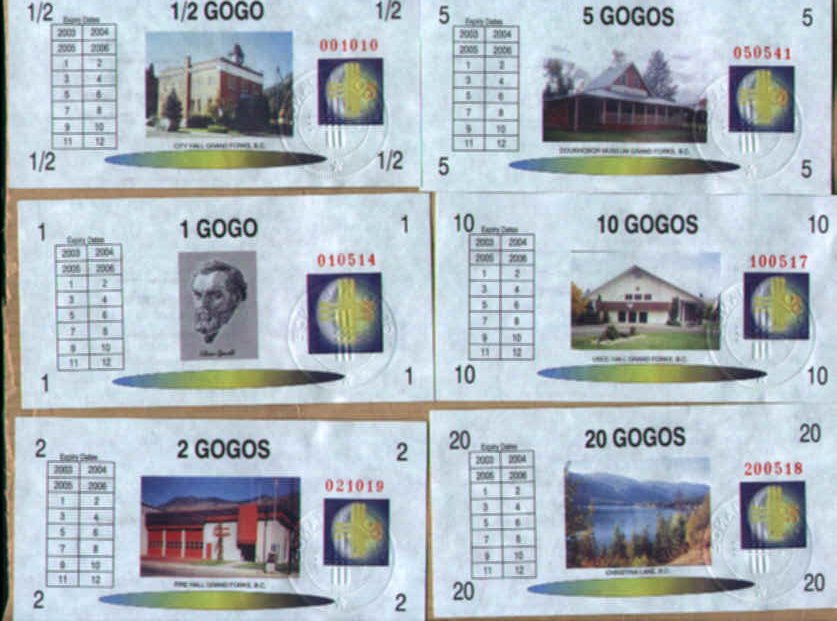

The Gogo is a note printed on secure paper. It features the image of Silvio Gesell, the originator of this form of currency, along with images from Grand Forks. It also contains the triple cross symbol, from alchemy, for aqua regia, which is an acid capable of dissolving gold. It also features spaces for stamps, on the front and back, which state the validity of the note.

Text on the note:

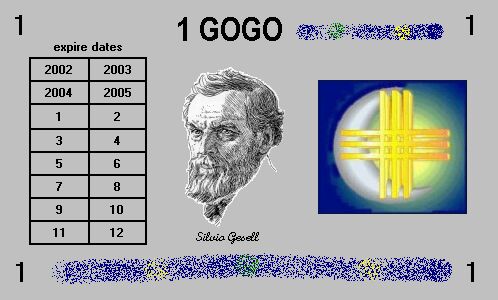

''This bill is guaranteed by the issuing agency to be kept at the exact value of V.80. That is the purchasing value of a Canadian Dollar in the year 1980. It is valid until the expire date and can then be exchanged for one with a new expire date one year later for a renewal charge of 5% (more or less). The agency will exchange the bill at any time for any available other currency at the appropriate exchange rate minus the renewal charge as long as there is at least one months validity left.''

----

Gogo works just like any other kind of money, it is used for buying things. It cannot be used as a store of value.

To get the Gogo, you must convert your Canadian Dollars for them, at the prevailing exchange rate, based on the value of the Canadian Dollar of 2001 relative to the value of the Canadian Dollar in 1980. At the time of writing, this is $2.20 Canadian for 1 Gogo. This exchange rate will change over time, depending on the value of the Canadian Dollar. The value of the Gogo will always stay the same.

The Gogo can then be spent like money at participating businesses.

If someone who is holding Gogos would like to convert them back to Canadian Dollars, they will receive an amount equivalent to the prevailing exchange rate at the time of the exchange, minus 5%.

Each Gogo note is valid for one year. At the end of one year, as validated on the Gogo note, the note will have to be exchanged for a new one, also minus 5% to be paid either in Gogos or in National Currency (either Canadian or US Dollars).

----

1. Stability

All National Currencies, like the Canadian Dollar, are unstable and decline in value over time. Do you remember the price of a loaf of bread, postage stamps, a pound of beef in 1980? How much do these goods cost now?

The Canadian Dollar has lost 55% of its value since 1980. The price of most standard goods and services now cost more than two times what they did in 1980. A 40 cent chocolate bar in 1980 now costs one dollar. This fact, along with the proof provided by the government in its Consumer Price Index, shows that the Canadian Dollar is losing its value.

This means that businesses cannot make effective financial plans for the long-term, because they cannot, with complete accuracy, predict the decline in value of the Canadian Dollar over that period.

This means that people cannot expect their salaries will rise at the same rate as the price of goods, and therefore they begin to fall behind. This problem is solved by the Gogo which will always be stable in value.

Image: The declining value of major National Currencies, including the Canadian Dollar, since 1980.

Purchasing power of the Canadian Dollar, 1980-2000.

2. Velocity

All National Currencies, like the Canadian Dollar, try to achieve two contradictory goals at the same time. On the one hand, they function as a store of value, and on the other hand as a medium of exchange. If money is used as a store of value, it means that it is missing as a medium of exchange on the market. This means that there is never enough money to satisfy all of the exchanges that are needed. Businesses cannot, ultimately, sell all of their goods.

The Gogo, by being stable and function as a medium of exchange, is always in sufficient supply in the community. It will increase business because it will help to sell goods that cannot be sold because of the scarcity of Canadian Dollars.

A healthy economy is one in which money is circulating, and this is exactly what the Gogo is designed to do.

3. Locality

All National Currencies, like the Canadian Dollar, can go wherever in the world they like. They usually go to where they can get the greatest return. This can starve small communities of the money to function properly.

The Gogo is designed to circulate only within a specific local area, and thus, unlike the Canadian Dollar, cannot drain out of the community to other areas. Thus, the Gogo will strengthen the economy of Grand Forks, and will always be there when we need it.

4. Transparency

We know what is best for our community. We need an honest and transparent medium of exchange which keeps its value forever, circulates around our community and does not leave, benefits local business and will be invested in our community. Ultimately, the Gogo will be of benefit to the people of Grand Forks.

----

How the Gogo got its name

Last time somebody asked me again what the name Gogo means and was not satisfied with the pat answer: „Money on the go!"

So here is the whole story as far as I can recollect. When the idea of a local money, which had the working title of "V 80 Can$" (The value of the Canadian Dollar in 1980 as measured by the Consumer Price Index) was discussed in a somewhat lubricated brainstorming session, it started with explaining what this money actually was. How to find a name for that monster?

If I remember right it went over, someone said ''why not call them ''G G'' for Grand Forks Gesell money?'', which became ''Gogo'' pretty fast.

Then all kinds of names for the ''Gogo" were suggested: Stabilo, because of its stability came close. Granda, Bobcat, Skunky, Peach, Goldy, Greeny, Super, Solido, Spunky are a few I recollect, but a funny thing happened. I also had liked Pemo for peoples money and Pecho for people changer. Every time some new name for the ''Gogo" was proposed, the Gogo was mentioned until everybody got so used to the name that everybody laughed when somebody said: ''Now I have to go-go. Tell me, if you find another name."

So Gogo it was!

In other towns and other countries they will probably use other names, but as long as they use a value of the past and stick to it and apply a small user fee to keep them in circulation even at low interest levels, it will be Gogos they have and they will set them free.----

Questions and answers about the Grand Forks Gogo.

Qu: As a Businessperson, why should I accept the Gogos?

Answer: Why not? You will make an extra sale. You are dealing for the first time in your life with an honest money, which keeps its value.

Qu: What will it cost me?

Answer: Gogos can be exchanged for Canadian Dollars at par value. At the end of the one-year lifespan of the Gogo, they will expire and it will cost 5% to replace the old Gogo with a new one. If you convert Gogos back to Canadian Dollars, there will be a 5% charge.

Qu: Where can I exchange them?

Answer: Any member store of the Gogo Alliance in Grand Forks will exchange them.

Qu: How are the Gogos backed?

Answer: Gogos are backed by the merchandise of the stores of any business willing to accept Gogos, as well as the other currency they were sold for and which is kept for exchange purposes. We expect there will be only about 10,000 Gogos in circulation to begin with.

Qu: What can I do with expired Gogos?

Answer: Gogos can be exchanged for new ones, for a 5% fee, or converted for Canadian Dollars, also for a 5% fee. To avoid the charge, Gogos can be saved with the Gogo Alliance and used for other purposes.

Qu: How many participants are needed to make the Gogo successful?

Answer: Similar programs have succeeded in areas with a population similar to Grand Forks. We believe the support of about 30 stores of all kinds are needed for a successful start.

Qu: Isn´t something like this already being done by barter clubs?

Answer: Not really. Even if it is local, it is not a medium of exchange like the stable Gogos and does not circulate any faster than other money. A group of 20 people or even thousand do not form a market large enough for money to move.

Qu: Why was something like the Gogos not started long ago?

Answer: There are many reasons. Mostly lack of knowledge, but also opposition by people who want to continue to suck money out of local areas and they could not do this with Gogos or similar local medium of exchange.

Qu: When will the Gogos be issued?

Answer: That depends on you and people like you. When enough of you ask us to go ahead, the Gogos can be issued by the Gogo Alliance within weeks. Without that the yet-to-be-formed alliance will not do it. Later they might be forced to do it for their own use if the economy deteriorates too much.

You can speed this process up if you put a sign in your store window, which says that Grand Forks Gogos will be accepted here right now. It will encourage the members of the alliance to go ahead and begin accepting Gogos.

Qu: How can I find out what the exchange rate is?

Answer: It will be published in the local paper on local TV and stores will show it in their store windows.

Qu: Are the Gogos legal tender?

Answer: No, they are not legal tender. If legal tender is required, you must exchange Gogos for Canadian Dollars. They are only a local medium of exchange, not real money. For all other purposes they can be used in complement to the Dollar.

Qu: Are there drawbacks to the Gogo?

Answer: No, there are no drawbacks to the Gogo. There are some people who would not benefit by using Gogos, namely, those who profit from war, those who profit from speculation and those who live off of the work of others.

Qu: How many Gogos will be issued?

Answer: Surprisingly few, because what is important is not volume but circulation. For the Sunshine Valley, we expect about 10,000 Gogos will be issued, of which about 1000 will expire every month and will be renewed at a total cost of about 42 Gogos per month or 500 Gogos per year. This small sum will cover printing costs, administrative costs with enough left over to ensure operating costs into the future. Any excess would go to community projects.

Only 10,000 Gogos moving 500 times a year can bring 5 Million Gogos worth of sales, translating into 11 Million Canadian Dollars worth of sales for the stores which accept Gogos in the area is something which makes it worth their small effort.

Qu: How many stores will participate?

Answer: We will be contacting stores to confirm their participation. So far, every business owner we spoke has expressed their support for the Gogo and has confirmed their intention to participate. Should there be a few business owners who would prefer not to join in the beginning is not a problem for the Gogo Alliance. People with Gogos to spend simply will not shop there.

Qu: Does the Gogo really need this complicated exchange rate?

Answer: The Consumer Price Index, on which the exchange rate is based, is the most simple, accurate and transparent way of determining the stable value of the Gogo. It is less complicated than the money market method of determining exchange rates, which has no basis in reality. You see by the difference between 1 Gogo, which is always equal to a Canadian Dollar of the year 1980.

Qu: Is the expiry date on the Gogo really necessary?

Answer: Yes, it is the motor, which combined with the small user fee keeps the Gogo in circulation and also keeps it close to the place where it has to be exchanged once a year.

Qu: Why should I bother about the Gogo at all?

Answer: You may find that it gives you that warm fuzzy feeling inside, like having done something good for your neighbour and fellow businessman today.

Qu: What shall I do to help the Gogo?

Answer: This question deserves a somewhat longer answer which will consider the stages of involvement.

1) Put a sign into your shop-window, which shows that you will accept Gogos.

2) Show that you are a friend of the Gogos by a pledge to buy at least 20 Gogos to jump-start their use. Exchanging your Canadian Dollars with Gogos will not cost you anything: you can still buy the same amount of goods or services with them.

3) Talk with your friends and encourage fellow businesspeople to do the same.

4) Join the Gogo Alliance, who will issue and control the Gogo and use additional means to get the Gogo in circulation.

5) Get involved with promoting and running the Gogos. After a month, they will promote themselves by the upswing in business they will generate and those who benefit from the Gogo will be the best advocates for the Gogos.

1)About the ability of the alliance to back the Gogos.

2)The full and sometimes harsh truth.

3)The harsh reality of the change!

5)Why does the Gogo need a user-fee6)Why lowly Gogos can be kept at a stable value, which no big currency could do so far.

7)Question for a business owner.

9)Gold standard is a dead duck

11)Fine print on the back of the Grand Forks money.

14)Where the Gogo can be used.

15)The real worth of monetary assets.

16)Additional benefits of the Gogos

17)Are Gogos additional Money?

21)The banks, Gogo accounts and exchange.

22)The ways to put Gogos into circulation

23)The real costs of the Gogo.

24)The hidden side of the Gogo.

26) The difference between Gogos and stamp script

29) Gogos and other currencies.

30) Statutes of the Gogobank society

31) Prosumers, the modern slaves.

35) Why is there no Gesell money, if it is known for such along time and is such a good thing?

36) Cast your bread on the water

38) Future benefits of the Gogo!

39) The enlargement of the Gogo area.

40) Long term effects of the Gogo!

41) The main features of the Gogos!

43) Dear reluctant businessman!

45) Some numbers from Woergl47) What is wrong with our Dollar?

48) The Gogo exchange booth50) The real start of the Gogos.

55) Gogos are better than Dollars

56) The simplest way to start a Gogo island.

58) The harsh reality of the change!

1)About the ability of the Gogo Alliance to back the Gogos. We will now look at a worst case scenario. The alliance sold some Gogos for the price of 2.20 Can$, let us say 2001 and after a year the Canadian Dollar has lost half of its value. The exchange rate would then be 4.40. Let us assume that the sum in question is 1000 Gogos ( about 1/10 of the amount of Gogos in circulation.

The alliance had 2,200 Can$ for that amount taken in but it also has the money for the rest of 9000 Gogos which they have sold at steadily higher prices - the last ones for 4.40 and what did it cost? Only the cost of printing the Gogos. About 600 Can$, by the way. This is, even inflation rate assumed, 29.700 Can$ plus the 2.200. Together 31,900. No problem to shell out the 4.400. We can surely disregard the 300 Gogos for printing also. :-)

See, inflation does not happen overnight and nobody in his right mind would even think in such a case to exchange stable Gogos for a money which he sees dwindling in value in front of his eyes. He would rather pay the user fee of 5% if he wants to keep the Gogos at home. More likely he will put them on a Gogo account at the bank. There it will depend also on the time frame whether he might still get some interest for long term deposits or has to pay at least part of the user fee to the bank for short term deposits.

The alliance has the whole difference between printing costs and nominal value as clear profit in its coffers as long as the Gogos stay in circulation and they will do this in both cases. On deflation of the other money anyway and also when the other money is highly inflated. The only time when a more frequent exchange can occur, is, when the other money is only slightly inflated and then the alliance has no problems either. The user fee will handsomely take care of slight exchange losses.

In Woergl hardly any money was exchanged. It was used and even the voucher accounts at the bank were usually transferred before the monthly fee was due, even when the exchange fee was only 2% while it costs 5% for the Gogos.

The voucher account transfers in Woergl did not have a huge volume, because in a local market fast moving cash can easily handle all payments. The voucher account transfers were also handled by the single local bank and therefore nobody paid much attention to them. Most people didn’t even have such accounts, only a few businessmen.

One must understand that the high use of account transfers today is only possible with high interest rates which make it possible for the banks to hide their high costs and the fact that cash does not move at low inflation rates - so everybody tries to stretch it by credit transfers.

Properly moving cash wakes this unnecessary and cash can handle all payments, as it did in Wörgl. Not because there were no accounts but because they were not necessary with properly moving money as the Gogos also will be.

2)The full and sometimes harsh truth. Here is a look into the logical results of the introduction of Gesell money, when started locally as was done 1932 in Woergl, Austria. There it was stopped by force after 14 months but here we will assume that it will be possible to avoid this. We will also assume that some necessary changes were made, like the introduction of an exchange rate and adherence to a stable currency reference standard. So now we start at the beginning, when a group of local merchants start such a Gesell money by the simple way of giving it out as a cash bonus of 1% with purchases.The Gesell money will have an exchange rate to the other money (we will call the other money Dollar and the Gesell money Gogo from now on, to make it more clear) which shows the stable purchasing value of the Gogo. The Gogo will also have expire dates at which date it has to be exchanged for new Gogos with a new expire date at a user fee of 5% once a year. (We will later explain why this is preferable to another possible way like stamp script, for keeping his money in circulation).

The stable standard will be the value of the Canadian Dollar of 1980, short V80 Can$ for value 80 and the issuing agency will guarantee this value of their Gogos.

What will happen now?

The small amount of Gogos (remember, 1 %, 1 Dollars worth per person in Woergl) will stay in circulation and will be used before the Dollars are used, because it will be some time before the people will really trust this new free money and, of course, they would not want to pay the user fee, if caught with a bill on expire date.

( The money of Woergl changed hands between 4 to 500 times a year compared to a „normal" turnover of the Dollar of 20 times a year)

So now these Gogos will push with every turnover wares on their one way street from production to consummation thereby removing them from the market, opening space for new wares and new business and giving with that former unemployed a chance to produce.

( In Woergl the unemployment rate dropped by 25% from an extremely high level in a very short time.)

Depending on the bite the Gogos take from the market less wares are left on it for the Dollar. The more the Gogos spread, the less wares are left for the Dollars and in a short time the owners of Dollars will realize that there are not enough wares left on the market for them to buy. Now the fight will begin. They will bid up the prices of the remaining wares and the Dollar will lose value even faster as it did before the Gogos. It would not matter to the value of the Gogo and to all credits or balances based on its value. The Gogo is isolated from the Dollar by the exchange rate,

(Therefore such an exchange rate is an absolute must for the Gogo.)

It is only the Dollar and all Dollar assets and, of course, Dollar debts which will change in value, probably losing it completely as other currencies did.

Yes, this is the somewhat bitter truth. The Gogo only by being a safety net for the community might hasten the unavoidable demise of the Dollar, but it should not be blamed for it.

Two aspects concerning the Gogo (the money which goes and goes.)

There is first the matter of the application of the user fee by the renewal charge instead of stamps. The reasons for this are besides the much simpler way of doing it once instead of by monthly or bi- monthly pasting of stamps, are twofold. It allows for greater flexibility if later it is noticed that a change in the fee is necessary and it also supplies an easy weapon against a possible attack. When enemies ( holders of large Dollar assets for instance) would try to make trouble for the Gogo by holding back and then suddenly releasing large amounts of Gogos they can easily be foiled by calling back more bills with future expire dates and raising the fee. Large amounts will anyway not be easy to get. ( Remember the 1%.) The holding back will became very costly for them, while it would not hurt the people using the Gogos properly. These people would not have much cash and will gleefully pay a higher fee for the little they might have just to hurt the would-be spoilers.

The second aspect is the possible over-issue of these Gogos but this is not possible by the way they are put into circulation. The businessmen who give them out, have to pay for them and they will not pay for something which they do not need, when the Gogos are coming back to them as payment for sales. It might be necessary to put Gogos which are exchanged back for Dollars to be replaced to avoid any slack. At least the amount collected as user fee must even be replaced. It need not concern us a lot, because the user fee which becomes due at any exchange back will make it too costly for people to exchange without need. People will use them otherwise before exchanging them.

There is no way to stop the spread of the Gogos. Once businessmen in the surrounding areas and towns realize the upturn of business for the ones who give them out and accept them they will do the same, even without necessarily going to the agency and buying Gogos. They only have to accept some in payment and then use them. They might give some out as bonus too for competition sake again, but it is not necessary. The only thing they have to do, is putting a sign in their windows: „Gogos accepted here."

3)The harsh reality of the change!We know now, what is necessary to overcome a deflation with Gesell money. We know how it must be done to be successful. We know how little of it we need and we know how fast it can spread.

I will only repeat what this money must have. It is 1) a stable reference point. 2) a market of critical size. 3) demurrage. 4) free space for it because the other money is not working any more either though high inflation or preferably through deflation. 5) motivated people and an issuing agency, which does not fold if opposed.

I will not go into each point because that was done before and sometimes in the near future this points will come together.

We know what causes the boom and bust cycles and nothing has changed therefor the same thing will happen as has happened untold times in history. Inflation will be brought to an end by deflation, where money will disappear from the market. We have had now a very long buildup and therefor inflation will be severe. It cannot be prevented any more either because there is just too much money floating around. The moment inflation starts to get out of hand, which it will, the owners of huge amounts of it will force the government of the day into a deflation policy and even a monetary reform. The small guys will have lost everything, while the big ones though diversification will still be comparatively well off, probably still also in precious metals. But now the disappeared money will be replaced by Gesell money which has never happened before in history.

This will not allow the money, which by hiding forced the wares to stay unsold on the market slowly to come back to pick up bargains. There aren’t any. They were bought by Gesell money. The age-old money game does not work any more and money has lost its power and therefor its value. The only money of value left is the stable Gesell money, which was only a safety net of about 2 Dollars worth per person and, of course, the contracts made out in this currency. The few new ones made out in the disappeared money after it had its reform (the former ones had lost their value with hyper-inflation) now lose their value with the money they are made out for.

There is one thing which nobody, but nobody has taken into consideration. It is the fact that with moderate inflation only a small part of the money (cash, legal tender) is in circulation on the market and there is not even a tenth of the amount necessary available, if all the owners of accounts would want their money in cash, which they have a right to ask for.

It is similar as it is with the price of shares in the stock market. A very few being sold decide the paper worth of a hundred times the amount of shares which do not move. They would be worthless, if they move.

Exactly the same applies to money. 5% of moving cash decide the value of all the rest - not only of the 95% of hardly moving other cash but also the value of all other monetary assets.

The funny thing is that if a part of the 5% stops to move on the market, as it does during deflation that people believe that the rest of the money including all monetary assets are now worth more, which they are - but only if they do not move.

This overhang of money does not allow a replacement of the disappeared cash by new one, which would be a simple thing to do. The Fed can easily find some bad risk debtor to sign a promissory note and can issue new cash for it. It is doing this anyway, but has to watch that this money feeds only the stock-market bubble, where everybody is happy when prices go up.

The fat would be in the fire, if it would reach the general market and would push prices up there too. Then all this huge amount of not moving money would start to move with appalling results. hyper-inflation! It is this horrible fact which nobody wants to admit. The Fed can only control a very small amount of cash and has no power at all over the more than 500 times larger amount which is in other hands. Now that we understand this, what has it to do with Gesell money introduced as a local safety net against deflation?

For that we have to look at the attributes of this money. It has demurrage and will therefor stay on the market removing wares from it. This means that the relation between available wares and the other money changes. There will be less wares and therefor higher prices for them. In other words money will lose value and will therefor start moving and - good-by deflation.

What about inflation? Not the inflation of the other money. That has run its course. It cannot be changed any more. It lost its value and with it the value of all its monetary assets as it has done untold times before. What about this new Gesell money? Remember, it stayed on the market because of demurrage but what about its value? No problem. It was guaranteed and proved it by always being exchanged at the proper exchange rate and it will continue to keep its value. It works like a catalyst helping to exchange goods and services whose prices may change but like a catalyst its own value never changes.

Now, of course, we might not have the old money around any more and will have to collect the prices for the cost of living index in Gesell money prices. That is all!

4)A simple business proposal The proposal for local Grand Forks money, the Gogo, looks complicated, difficult and unusual only on the first look. In reality it is very simple and every businessman will understand it in a very short time applying only normal business sense to it.Given the fact that business is slowing down and there seems not to be enough money around self-interest should let everybody make the effort. This local money would increase the available money in the community and because it is local, it would stay in the community and not disappear in all different manners as the national money does.

This is one point. The second point is that this money has a time limit. It has an expire date, so it has to come back to the issuing agency once in a year and can therefore be controlled whereas the national money cannot. The exchange or user fee of 5% would also make it possible for this money to be managed in such a way that it would keep its purchasing value. This is another thing which the national money was not able to do.

The user fee would also keep this money in circulation generating untold sales which is also something the national money cannot be depended on, as is shown by the dismal business volume.

This is actually all somebody needs to understand. This money, given out as a sales gimmick, as a bonus of whatever percent a businessman wants to give (1 to 3% advised) will not, as the Canadian Tire Money does, have only value in one store which prevents its circulation and this is the huge difference. This is not the only way the Gogo will be put into circulation. The friends of the Gogo will do that also to jump-start its use. This money will CIRCULATE and by doing so generate up to a 500 times its value in sales.

It could, of course, be a bit less if a turnover of such a money of more than once a day is not possible. It was in a former experiment but it does not really matter. Even a sale once a week would more than triple the sales our money now allows including even all the sales through credit transfers. This should do for a start.

Some might say that they do not want a money which forces them to buy locally because they can get goods cheaper somewhere else. Such a view is wrong because they do not consider that they have gotten the local money from local people and have earned a profit and now they should return the favor but nobody forces them to do it. They can always exchange the Gogos if they can get something more than 5% cheaper from somebody who doesn’t accept Gogos.

The local supplier has only these 5% which he can be more expensive. This isn’t much of a force. The convenience of buying locally, the saving of travel costs, better service and guarantee usually amount to more than that. Besides that, the Gogo doesn’t replace all the Canadian or US Dollars in circulation only some and therefore every businessman will still get plenty of those to use where he cannot use Gogos.

Should the Gogos really take off and replace a lot of the other money then it doesn’t matter either because then they will be accepted by most partners one needs to trade with - even ones farther away.

5)Why does the Gogo need a user-fee The Gogo needs the user-fee to stay in circulation as a medium of exchange. It makes it not as suitable as a store of value. For that purpose people can use gold or silver and even the government money if they believe that it will keep its value. Using the medium of exchange as store of value means to remove it from the market as medium of exchange and this brought about the endless boom and bust cycles and wars since the begin of history.Because the Gogo stays in circulation, it can also be managed in a way that it keeps its value. To have such a standard of value is worth much more than the 5% it will cost the person who happens to have one when it expires. On the average it will have been used during the year it is valid some 500 times. The real cost is therefor negligible for people who use it for what it is meant to be used. For buying and selling. Actually it is the 500th part of 5% for every trade done with a Gogo. It is a joke, if somebody is afraid of this and lets himself be scared off by people who profit by wars and depressions and therefor want them to continue and fight an honest money.

People can also escape the cost by the simple way of lending the money to somebody else. Then he or she will pay the fee.

The simple way the user-fee is applied to the Gogo and the way it is spread over the whole year makes it easy to manage. There will never be any bottlenecks.

Gogos are a local money and while they can move freely during the whole year, once a year they have to come home to be exchanged and that makes them controllable. That is the reason for the user-fee.

6)Why lowly Gogos can be kept at a stable valueThis is really the question which should be answered without any room for doubt, because it sounds unbelievable that a local money can do, what escapes all other currencies advised by the most revered economic scientists since the time money began. We know that the Gogo will have the purchasing value of the Canadian Dollar of the year 1980 and this value will be shown by its exchange rate.

The agency will buy and sell (subject to the fee) any amount at any time, which, of course, means that everybody else will do it at the same rate. This is simple and not unlike the open market policy which is used by all currency banks.

The question is. Can the agency do it? And why? What gives it the power to do what obviously the National banks cannot do despite their promise to keep the currency stable?

The answer is simple. It is the expire date and the renewal fee of 5%, which the other money does not have.

Gogos will be continuously sold and bought at the prevailing exchange rate so it is not as if large amounts which were sold at a low exchange rate have to be bought back at a high with a huge loss. It will always be small sums where occasional losses are easily covered by the fee. The fee will also prevent the buildup of huge cash-holdings of speculative money and therefor nobody could use disruptive methods of moving huge amounts of money as is done with the other currencies, where 98% are used this way.

Speculation in Gogos will be too costly for speculators and because of the small amount of steadily circulating Gogos every such attempt will be noticed right away. With the money of today this is not possible because of the huge unnoticed hoarded amounts of it and the time-lag involved.

One could compare it with a small group of horses on tight leashes in the hands of the alliance to a lot of free running horses which can be spooked to run in every direction and can easily be stampeded of the National Bank and the government.

7)Question for a business owner. Some businessmen in Grand Forks plan to start a local money like the Canadian Tire money. It will be a little bit different because it will be accepted by more than one store and will therefore circulate and generate more business. The more the merrier. To keep it in circulation it will have an expire date as shown on this sample bill and it will have an user fee which will be collected at the time of renewal. It will not hinder circulation, because it is known that such a bill will change hands as much as 500 times a year. The 5% therefore divide up to 0,01% for every trade.This fee will also make it possible for the alliance of businessmen who issue this money to guarantee its purchasing power, which will be exactly the purchasing power of one Canadian Dollar in the year 1980. It says so on the bill and it will be proven any time by the alliance because they will take them back.

But, of course, the idea is to keep this stable money in circulation and therefore such an exchange will cost the 5%. But one doesn’t have to exchange it. There are plenty of businesses which will sell you gladly whatever you want to buy with them.

It will also be accepted in the US. The simple question now is: „Are you going to be also one of the businessmen, who will accept these Gogos? It will bring you a lot of new business and you do not need to accept 100% Gogos on every sale. You could go as low as 10% Gogos and 90% normal money, if you have the feeling that you might have a hard time of getting rid of them. It will be up to you and your customers and, of course, your competition. If it sells for 100% Gogos you might have a problem selling for Gogos and Dollars.

You must understand one thing. The Gogos are local and regional money and the will stay around and come back into your store untold times, because they cannot disappear to Toronto or Washington.

All you risk is putting a sign in your window saying: „Gogos will be accepted here." Whenever you think, it is not worth it, just take it away. There are some businessmen who give Gogos out as a bonus like Canadian Tire does and this is perfectly all right for somebody who wants to bring them into circulation and at the same time use it as a sales gimmick, like Canadian Tire does. You should only not take them as payment for the same sale. This would not put them in circulation.

The worst that could happen to you, if you have taken more Gogos in as you can use, is, that you have to exchange them at a loss of 5%. But remember, they brought you a trade, where you probably earned a lot more than that.

It is sure that you can see the benefits which the Gogos can bring not only to your business but to the whole area. So do the little part of giving them a try. Once the Gogos are issued the alliance will give you a sign which only says: „Gogos accepted here". This is all we ask. What percentage of Gogos you will accept for every trade is up to you.

I explain it once more: Yes it will cost you 5% if you want to exchange them back, but if you only took 50% Gogos in a deal this would only amount to an discount of 2.5%, far less than you have to pay for mastercard. There is also the other side. You can use the Gogos to buy something locally and thereby treat other business owners as you would like them to treat you and keep thereby the Gogos moving locally. Then it would not cost you anything at all.

Let it develop. You are not asked to do much and you are risking nothing but more business.

The first half of the 20th century was marked by two world wars and the great depression. All of them a direct result of the gold standard which causes always a deflation if strictly adhered to. To overcome the dire results of deflation which were most markedly seen during the great depression in the thirties the states have to abandon it every so often. The great depression was only ended by the war as was the one 1912/14 by the first world war.Wars usually cause inflation. The second half of the century was marked by that. Even in the more stable economies the value of the money declined by about 90%. Many countries experienced a total loss and it is only a question of time until the still more stable currencies will go the same way unless a gold standard is re-installed.

Should that happen history will repeat itself. A depression of worse proportions than the one of the thirties will occur and nobody will realize what the cause is. Rabble raisers will use the mass of unemployed desperate people to come to power and the next war is bound to follow. It could be the worst of wars - civil war. It has happened already in many countries of the world and is still happening.

So far the worst could be prevented by keeping inflation going and having abandoned the gold standard this could be done but it cost many countries dearly which could not hold inflation down to a bearable level. The problem now is that the steady influx of inflation causing new money has brought a huge overhang of Dollars in the whole world and those are an always possible threat of much higher inflation if they return.

The only way out of this vicious circle is the installment of a stable currency without inflation but also without deflation which means without the deflation causing gold standard. A cost of living standard must be used instead.

Simple lowly Gogos are such a currency - so it could be said:

Go Gogo - or die in the next war.

9)Gold standard is a dead duck

When Milton Friedman called the gold backing of the Dollar the smile of a vanished Cheshire cat he only said the truth but now some people are talking again about some new Bretton Woods with a return to a gold standard. They seem to think, that fixed exchange rates forcibly introduced this way could curb world-wide inflation.It could be done, but only at a fixed gold price and that would mean tying the economy again on the fate of a single price of a not very useful good. In former times this was often done and always caused a depression, which was then cured by diluting the gold standard and abandoning it in the end, to wage war.

In order even to get back afterwards to a gold standard again, the paper money had to be deflated. When there was too much in circulation it had first to undergo a monetary reform. We are now in a situation where more paper money than ever before in this world is around. I do not want to say in circulation because most of it isn’t and sits only around. This money has to be taken into consideration, if a gold standard is to be introduced and that is the problem. It is just too much. A gold standard could only be started after a currency reform, not instead of one.

Of course, people do not understand what hits them as far as currency is involved, but it is hard to imagine that they would stand for a currency cut out of the blue, without getting rid of the government who does this to them. The large amount of paper money now makes it impossible to follow the way of a deflatory reduction of the paper money which was used before. There was never before such a lopsided situation, the result of nearly 60 years of „deficit spending" and by compound interest steadily growing debts and the opposing monetary assets.

To jack up the price of gold instead is also out of the question. That could not be contained for the gold price alone. Most other prices would go up also and that must be prevented or the economy collapses in a hyper inflation when the monetary assets start to move.. So far this has been prevented by manipulating the gold price down which is in a sense more like manipulating the Dollar value against other currencies up. This allows the influx of cheap goods into the American market and thereby keeping also inflation down. Without this, paper money would have to be pulled out of the market and this would mean collapse also. This time by deflation.

One can turn it any way, it would always end in economic collapse and therefor the gold standard is a dead duck - never to fly again.

Everybody thinks that he knows what money is and how much it is worth. It is used daily to buy all kinds of goods and services and is received as payment for the own goods and services. The prices of the goods decide what the money is worth used to pay for them. So far everything is clear, but there is a not so little snag in this definition. By USING the money and only for the money used the value is decided on the market and now people think that this value also applies to all the money which is not used.This belief is fostered by a lot of people who do not want to destroy the illusion but the truth is that just as a few sales of shares on the stock market decide not the real value of all the shares which are not moving, only the so called paper value. This value could drop to nothing, if those shares were sold.

Exactly the same is the case with the not moving money in the vaults or savings accounts. Their value would go down to near nothing if large amounts would move. It happened in many countries of the world and the Dollar escaped despite the over-issuing of it so far only because people in the whole world are holding on to their Dollars not moving them. If significant amounts would start moving into the market buying goods people would soon find out that their Dollars were not worth as much as they previously thought. In other words the prices of goods would go up and that could lead to a stampede, where everybody would try to buy something, anything with this money which obviously loses so much on value. This would, of course, speed the demise of the money up still more. It was experienced in many countries.

Now the overhang of idle money is at dangerous levels and the slightest loss of confidence could start an avalanche at any time. Then, sorry to say, the real value of the Dollar will surprise everybody. When this will happen is still the question not that it will happen. It is the same as with the stock market crash. It is bound to come, but who knows when. It could happen next week and it could still be prevented for years.

Exactly the same goes for the Dollar crash. It will happen just as it happened to other currencies. The question is - when? There is not the slightest evidence, that our economists learned something new in the last fifty or even 80 years and the people in Latin America or Africa and other countries went to the same Universities as the European and US. economists and they failed dismally. Ours will fail as well.

We better be ready to help ourselves and there is a way, to do just that. It is the Gogos! The main reason for that is, that Gogos cannot build up large overhangs of dangerously idle money. They are a money on the move and by moving stimulate sales and business. They can therefore be controlled like a boat under power can be controlled and they can be kept at the exact value of the Canadian Dollar of 1980 as promised and guaranteed right on the bill. This means: no inflation for them but also no deflation which can be even more deadly for an economy.

Fact is, we will have to do it ourselves because no government can admit that they steered the currency to the point where it is worthless and that therefor all owners of monetary assets, which they were pushing all the time have nothing but worthless paper in their hands. They will try to keep up the sham as long as possible.

Let us hope, that in other countries around the world, they can also help themselves in the way of the Gogos to overcome inflation as well as deflation and , sorry, your money is not worth anything now. Do not blame the Gogos for it.11)Fine print on the back of the Grand Forks money.

''This bill is guaranteed by the issuing agency to be kept at the exact value of V.80. That is the purchasing value of a Canadian Dollar in the year 1980. It is valid until the expire date and can then be exchanged for one with a new expire date one year later for a renewal charge of 5 %(more or less). The agency will exchange the bill at any time for any available other currency at the appropriate exchange rate minus the renewal charge as long as there is at least 1 month validity left.''

This is all that is needed. The exchange rate to Canadian and American Dollar will be published in the local newspapers and displayed in store windows and wherever necessary in Web sites. What the banks will charge as difference between buying and selling this currency will be determined by the market as it is now with other foreign currencies. Competition will keep the price of this service down. Exchange booths will take the place of the banks if they charge too much and they also will compete with the best rates. Usually the banks will have them as can be seen in Mexican border towns. The other exchanges can have only slightly higher rates for convenience outside of banking hours. There will be very little exchange. The user fee will prevent most.

Whether the stores will display their prices also in Gogos, ist up to them. In the beginning they probably will not, but later on they might prefer to do it, in the US as well as in Canada. The stores now only display the prices in their own currency but everyone in the border area takes the other money and uses the exchange rate. It will be exactly the ame as with a third currency. No problem. Everybody will know how much Canadian or US Dollars the Gogo will be worth.

As for the ability of the issuing agency to keep the value of the Grand Forks money. This is simple. The renewal charge gives it enough leeway. This money will be bought and sold continuously (not necessarily in large amounts because people would rather try not to pay the renewal charge and exchange the money only if they really need to do it and there are not such large amounts of cash in circulation anyway, as we have shown). Therefor only a short time between selling and buying back has to be covered. So even if the Canadian Dollar should lose 50% of its value in a year the 5% renewal charge would cover a whole month if all the Grand Forks money in circulation would be exchanged. This would not be likely. Who would exchange stable money against one losing that much in value? In such a case the agency would have even to try getting rid of their Canadian Dollars by buying durable goods.

Nobody needs to worry about the ability to hold the value of the Grand Forks money. There is more to worry about the value of the Canadian Dollar. :-(.

Now, in case the Canadian Dollar keeps its value, as we all hope, there is no problem at all for the agency. It has the Canadian Dollars ( or American Dollars ) it received for selling the Grand Forks money in the cash-box or in their account and simply use these to buy back any which the people bring in. Every time this is done they make 5% and they would laugh all the way to the bank.

With the spreading of the Gogos there will for a long time alway be more sold or given out as credit than are bought back or are coming back as credit repayments.

( the more or less in the fine print gives the issuing agency the means to reduce the renewal fee if practice shows that this would be necessary to have the Gogos more readily accepted or raise it, if the Gogos would be the target of an attack to destabilize them by selling and buying in larger amounts.)

In Japan another alternative money is put into circulation which has some similarities to the Gogo but also a lot of differences. The basic idea is the same. To use some stable means of exchange beside the not stable and often missing money of the National banks. Now to the differences:The Value:

The Watto is, as its name suggests tied to the kilo watt hour. This is a very simple way and because it is the price of energy which has many ties to other prices is better than any other standard which uses only one commodity or no standard at all.

The Gogo uses the worth of the Canadian Dollar of 1980 as standard measured by a cost of living index. This might look more difficult but is a much more exact standard of value.

The way to be issued and put into circulation:

The Watto is issued by a member of a barterclub like a promissory note and like one of them circulates later by being indossed and used like this by subsequent users until it comes back to the original issuer to be redeemed. As it could be used without indossing anew in between it might circulate quite often before coming back, but it is doubtful how fast it will circulate. An expire date alone would not help.

The Gogo is issued by the Gogobank and sold or borrowed into circulation not to a limited club, which might have long distances between members, but to the general public, where a lot of businessmen have already put signs into their window that they will accept them. A much faster circulation is thereby assured, because it reaches a real market, not a make believe one.

The exchange rate:

The Watto has no exchange rate as such, only a price. While it could be exchanged for money instead for goods or services this is not intended.

The Gogo has the exchange rate determined by the current difference of the consumer price index to the one of 1980. Exchange is discouraged by the renewal fee of 5%, which will be charged for exchange, even if the expire date is still a year away.

Demurrage:

The Watto has at he time being no demurrage charge. The limited circulation does not warrant it. This means that no speed up of circulation can be expected.

The Gogo has the user or renewal fee of 5% which will be charged when expired notes are exchanged. This will work like demurrage and the general acceptance in an existing market consisting of many businesses and their customers will speed up circulation slowed only by the movement of wares and services. The Gogos have to slow down when they have taken the existing wares from the market to wait for new ones to get there and, of course, services take time also. One cannot pay faster for a month services than once a month.

13)The features of the Gogo. The Gogo looks different to other money basically only by the table of exchange dates and the guarantee of the same purchasing power as the Canadian Dollar of the past. Exactly of the year 1980.It has the ghostly Dollar of 1980 watching over its value and the renewal cost on the expire date makes it possible for the Gogobank to keep it by the simple means of buying or selling any amount of them at the appropriate exchange rate, which is tied to the cost of living index which shows the value of the Dollar of today.

At the same time this renewal fee will keep the Gogo in circulation and in the vicinity because it has to come back to the Gogobank once a year for renewal.

What benefits a stable money brings which stays in circulation in the area is explained in other chapters and will be noticed by everybody in a very short time once Gogos are put into circulation.

The Grand Forks Gogo will probably be the first local money with exactly these features in the world.

Value 1980 is considered by some but most want to start pari with their own national money, even when they consider an exchange rate later. Some will use stamp script as demurrage. Some like the Watto of Japan go a still other way. There are as many different approaches as there are clubs or barter groups, but so far none of them have found a really successful way to reach the general market and nobody tried to reach the business owners in this market ahead of time. Nearly all of them try without success to form an alternative market, some even without money, instead of using alternative money in the real market.

. The 500,000 members of the club del Tuerque in Argentine with their Creditos made the mistake of letting them at the value of the Peso and because the Peso is in trouble their Creditos are also. With a stable Credito they could have introduced the demurrage they had planned for last year and that would have spread it and would have speeded up circulation of a stable money like the Gogos will be.

14)Where the Gogo can be used. The short answer to this is: wherever it will be accepted. That is in all the stores which display the sign : „Gogos accepted here." They can therefore not be transferred out of the area and must benefit it by staying in local circulation. The Gogo area at the beginning probably being spotty but in some cases extending for 100 km. One hour driving time distance might be all that can be be handled from one location.They cannot be used where only legal tender is accepted because the Gogos are not legal tender.

There is even right at the beginning a large enough base of acceptants and therefore no danger of finding no place to use them. Why the stores will accept Gogos is a basic question which can also be asked for the Dollar. They accept those also not because of the pictures printed on them but because others will accept them and give them goods in exchange for them. Exactly the same is the case with the Gogos.

The store owners have sold goods, hopefully with a profit and will use them to buy goods or services with them now for themselves. This is how trade works and with Gogos it is not any different.

The only difference with the Gogo will be that it will stay in local circulation by the features which are built into it. Those features will also prevent that it will be used for other purposes as buying and selling even locally. It is not suitable for saving. That must be done by other means. The 10,000 Gogos should go, always go, as their name suggests.

They need not run, because the 5% in a year user fee is not really pushing them that fast, it will only prevent them from staying idle for long times.

They will slowly and steadily move goods and services taking up the slack the official money left by leaving the area or staying hidden.

15) The real worth of monetary assets.

Money is worth what can be bought with it. This is such a simple statement, that nobody will give it a second thought. It is a truism. Anybody can prove it for himself by going on the market and buying from the most reasonable seller and that is when his money is worth the most. The give and take on the market not only decides the worth of goods, their prices but also the worth of money that is how many goods one can get for it.

What nearly nobody including most economists understands, is, that it only decides the worth of the money on the market at that moment in time. It is clear that if more money from the monetary assets would reach the market, money would lose some of its worth and would become completely worthless if all the monetary assets would be used this way.

We are not talking about inflation with over-issuing of money now and assume a fixed amount of money and we also assume a fairly constant supply of goods on the market not to murk up the basic conclusions.

What happens on the market when some people do not use their income of money to spend it but save it?

We are again talking about the saved money which is not used by others. We are talking about the money which is used as store of value ( in former times as gold coins). It is missing on the market and some goods stay unsold and slowly rot away losing on the average 3% of value in a year. So after a year 3% of the goods which gave value to the money are gone while in our current system the money in the monetary assets increased by the interest. There is after a year already a spread of 6% assuming 3% interest.

Continue this for a few years and most of the real value of the monetary assets rests on thin air and the day of reckoning will come once again and when it was pushed by increasing the money supply into the future it will be the worse for it. The funny thing is, that nobody realizes this because of the glut of unsold goods on the market. It looks as if there are too many goods and not enough money.

In reality it is just the opposite, only the money never reaches the people who would need the goods and would buy them. It is in the hands of people who do not want to buy something at the present time and who are only looking for interest bearing assets. As long as they can find them some small parts of the money trickle back to the market and the life of illusion can continue - the illusion that the monetary assets have real value.

That this illusion has ended in many countries again and again doesn’t seem to give second thoughts to the economists. There must be something wrong in this system where in every generation one monetary collapse at least happens. Could it be the fact that we try to match aging goods with seemingly ageless eternal money when we trade with them on the market?

Is money really eternal when it dies every generation when it cannot be matched any more? When will that happen to the Dollar? What made it so longliving? Could it be the spoilage of the currencies of the rest of the world? Was it feeding on them like a vulture? It seems like it, when one looks at the interest payments of the third world countries, where an original loan despite paying back within a few years twice the amount (including interrest) they now still owe twice as much as the original loan was.

The Question what the Gogo has to do with the above comes to mind and why this is on the Gogo page. It has something to do with the Gogo. We know that the Gogo bills will all stay on the market and one doesn’t have to worry that there will be a disruptive overhang of them as there is with the money of today, which is not on the market. That is one point and there is another long term one. Nobody will pay interest for a loan of Gogos, when the one with surplus Gogos he wants to save is known to have to pay the renewal fee every year. He will have to settle for repayment without interest and he will do so, because the Gogo he gets after years will have kept its value and that is worth more than interest. Here goes the second part of the spread we showed above. There is no missing money on the market and therefore no surplus goods which lose value and there is no interest to increase the monetary assets nominally.

The field between goods and money is now level. The productive power of mankind can now for the first time in history push the interest rate down to Zero without interrupting the economy by deflation.

Lowly Gogo will not do it alone and one small area in the whole world will not bring the interest rate down, but for here and now it will be a medium of exchange which knows neither inflation nor deflation. It will always be as much worth as the Canadian Dollar was worth 1980. Kept up long enough the world will notice. It can be kept up because the small user fee of 5% a year enables the Gogo alliance to hold the appropriate exchange rate for ever.

Gogoland will be a heaven of stability with steady trade and work for all. More we cannot expect from lowly Gogo.

16)Additional benefits of the Gogos. The benefits of the Gogos for the local economy are already known by all participants but there are more. Because of the user fee which is applied every year the Gogos stay in circulation and because this user fee will be charged ahead of time when exchanged back nobody can escape it.

This gives the Gogobank the means to hold the Gogos at exactly the value of the Dollar of 1980. This was made clear to everybody and all the businessmen who agreed to accept the Gogos understood this all and saw the benefits for themselves and the community which will arise from introducing the Gogos.

But there are much more of them in the long run. For one there will be no unused Gogos and therefore no dangerous overhang of them can develop and nobody in his right mind would pay interest for Gogos somebody would like to lend him, when he knows that they will cost the owner money to hold them back. They will still be lent out from people, who have at the time no other use for them and want to save them for later. The only thing will be that they would not get interest for that or very little, but for that they will have the security to get something of the same value, the value of the Dollar of 1980, back. This is a benefit which many people in the rest of the world would have appreciated. Maybe soon also in North-America.

Without interest it would make no sense accumulating vast amounts of monetary assets and without interest earnings it would not be easy to do. People would save by other means, like having beautiful homes with other stores like good wines in a cold-room. The accumulation of monetary assets as well as other assets only being possible by work, it is only a question of time until people will realize that it is senseless to work until death and will take life more leisurely. This will not only be a benefit to them but also to the environment.

Without unwanted unemployment and with prices of goods not including interest anymore (which is, including the interest the government has to pay, and which it has to collect as taxes, about half the price on the average) everybody can be sure to make a good living by working very little time and that is something we cannot even imagine what that will do to the life of people. One thing is sure although. When it will be so easy to make money by working the people, who are able to work, will be generous with the few, who are unable. This will be another benefit of the Gogos. They will be a money of generosity.

These are only a few of the added benefits of the Gogos not the least one that there would be no more wars, which are fostered by depression and unemployment.

This might be the greatest benefit of them all and let us hope that the words of this Mitar Tarabich, a Serbian seer will come true:

„....those who will run and hide in the mountains with three crosses will find shelter and will be saved to live after in abundance, happiness and love, because there will be no more wars....

17)Are Gogos additional Money? This question can be answered with a no. They are not additional money because the Dollars which were paid for them stay instead as backing on the books of the Gogobank. It is exactly the same as with the gold or foreign currency as backing for the Dollar.Even if some are given out for promissory notes this is only a temporary addition, just as it is with Dollars given out on such a basis by the National Bank. They have to be returned in usually three months time.

The Gogobank will always have balanced books and it will say so in its bylaws It will also be open to audit at any time to prove this.

There must always be enough assets to balance the Gogos in circulation.

It might have double the time frame for the few promissory notes it might take in but it will not allow a prolongation of those as the National Banks do. It would not be prudent to do otherwise and would lead to over-issue of Gogos.

This is something the Gogobank cannot allow because of its guarantee of keeping the Gogo at the same value as the Canadian Dollar of 1980. In fact, the Gogos will be held at a much tighter leash than the Dollar is, because of this.

The Gogobank must be very prudent because nobody will pail it out if it cannot prove day for day that it is able to keep the Gogo exactly at the same value as the Canadian Dollar was 1980. That is what it guarantees right on the Gogo bill and it has to prove it by buying any amount of them back at any time.

Therefore it cannot overdo it with giving out Gogos for promissory notes either. This will be only a very small part of its operation. It does not need to do it either because of the mall amount needed. It is different with normal money where much more is needed because so much is used as store of value.

18)Uses of the Gogo. When Gogos are taken in by a businessman there are a few restrictions to their use compared to Dollars. He cannot use them everywhere and therefore might have to exchange some of them for Dollars. We know that this will cost him 5% so it is interesting to find out what else he can do with the Gogos to avoid this cost.First and foremost he can buy something with them locally from everybody who accepts them and this is the main reason Gogos were introduced in the first place - to keep them in circulation within the area and providing employment and additional sales.

Buying locally means, of course, also buying local services like paying employees or tradesmen with them. This will provide work and employment locally.

Next use is investing the Gogos locally. This is also a huge benefit to the community. It can be done directly or by putting the Gogos into a Gogo account and then the bank can do it instead. It will also face the same restrictions and will be forced to invest locally.

There is besides paying taxes and postal services only on other thing the businessman cannot do and that is - paying his suppliers from far away.

Here is the fact that the Gogos are after all only a supplementary and complementary medium of exchange. A businessman will still take in Dollars too. He will simply use those for these purposes. In case that his Gogo income is so much and his Dollar income too small - only then he will have to exchange some. It will not break him to do this because the Gogos brought him more profit than the little bit the 5% cost of exchange for small amounts will be.

Should a business person find out that he will get more Gogos as he can use, it is a simple matter. He or she can exchange the surplus and it will probably only be a very small part of earnings of the additional sales generated by the Gogos or he can tell his customers that he will only accept part of the payment in Gogos taking the chance, that a Gogo customer might go to his competition. A Gogo customer, is, of course, being somebody who has Gogos, which he had earned before.

As said before - nobody will be forced to accept Gogos - no businessman and no tradesman and no employee - but it will be wise to accept t least part payment in Gogos, depending what the competition is doing. The Gogos will cost him only 5% if he wants to exchange them right away. He has until the expire date time enough to use them locally. There is no rush only the gentle remainder of the expire date. The Gogos will not disappear. They will stay around in the area and nobody will hoard them even when he can use them as a store of value until their next use. For most he even has a year time for it in the beginning and only later the time will shrink to half a year on the average.

The Gogos are designed for a gentle transition - unlike the stamp script of old. Every worker will accept them as payment, when he sees that the stores accept them and every store owner will accept them, when he sees that other store owners, tradesmen and workers accept them for their wares and services.

The Gogos are a medium of exchange like the Dollars but they are a better medium of exchange because they are a worse store of value for the long term because of the user fee. To offset that drawback they have a stable purchasing value and it is a matter of preference for everybody. Somebody prefers an unstable Dollar - fine - he or she can continue to use them as long as they like. Somebody wants a stable medium of exchange and is willing to pay an user fee of 5% a year for it, it should be fine too. They can even use both, as long as they want.

19)Friends of Gogo. In order to facilitate the continuos acceptance of Gogos and speed up the original introduction as well as the replacement of Gogos which are exchanged back a group is forming which will buy Gogos for no other reason than putting them in circulation. It will cost them nothing because they will use them to buy the same amount of goods they would have used the Dollars for.

The only reason they are doing this, is, that they know what benefits the Gogos will bring to the community. Quite a few members of this group are among the business owners, who agreed to accept Gogos. They are going to buy Gogos to use them and will so jump-start their use.

It is a completely informal group without a membership fee and most members so far do not even know each other.

It is in the future whether a more formal club will be formed with social functions and talks about the background of the Gogos and their future possibilities.

Everybody knows that the more Gogos are in circulation the more are likely to come back to him. So, while in the beginning mostly articles for daily use will be bought with Gogos and for larger articles only part of the purchase price will be paid in Gogos, later even sales on credit might be done on a Gogo base. The seller will know that the ghost of the Dollar of 1980 stands guard over the value of the Gogo and will therefore prefer to use them.

It will be a milestone of sorts, when the first house will be sold on that basis.

Let us hope that the members of the friends of Gogo will not be called after the first letters of that name F O G: Fogey’s.

20)The Gogobank. The Gogobank is not really a bank. Legally it is just a public service society formed with the sole purpose to provide a local medium of exchange when the governments money does not do this part of its function well.Its statutes are clear forward and the book-keeping standard. The balance sheet will show the issued Gogos as liability of the society on one side of the ledger and cash, foreign reserves in form of Canadian and US Dollars and accepted interest-free repayment notes for loans on the other side. There will also later some reserve fund be there if there is a surplus in the operating costs. The society can operate in the red up to a limit of 1000 Gogos, which will be covered by the personal guarantee of its officers. In the unlikely case this sum is exceeded the society will ask for donations and they will be forthcoming by the people who will see how beneficial to the economy this local medium of exchange is.

In the beginning there will be a 10.000 Gogo limit until experience will show if more are needed and demanded by the market. There is not expected that more are necessary unless the area of use expands a lot. The Gogo is not replacing the Canadian Dollar - it is just supplementing it, therefore not more of them are needed.

The psychic part of the Gogobank will only be one or more safety boxes at credit institutes which handle Gogo accounts or one or more strongboxes in the stores of society members.

The Gogobank will never show any profit, because the minimal surplus which could occur with the minimal income from the user fee, which is even when the full amount of 10.000 Gogos is in circuation only 500 Gogos a year, must be put into the reserve fund.

It does not need any profit because it is not really a bank, but a public service provider for a minimal fee.

So it is clear that just as the Gogos are not real money (legal tender) the Gogobank is not a real bank. As a point aside, the Gogos themselves are not valid the way they come from the printer numbered and with safety features. They need to have a validity stamp from the Gogobank and an expire date indicated by two punched holes on the expire date table on the note.

21)The banks, Gogo accounts and exchange. While the banks are not really necessary for the Gogos because with a fast moving local money transfers are not such a big deal, it would be in their interest to get involved. They would not want to leave the business to the pawn-brokers.The features of the Gogo, of course, will need some re-thinking by the banks. There is no problem to carry Gogo accounts. It is the same as carrying a foreign money account. The exchange rate is just the same clear cut deal. Only the user fee of the Gogo will have to be considered.

Every owner of a Gogo account will know that a bank will not pay his user fee of 5% a year or 0.416 a month and will not squawk if the bank charges it to him for a daily account, even knowing that they might lend some of it out. This is their legitimate income. He will, of course, never have a lot of money in such accounts unless the banks will charge less than the full user fee.

They might do that when a minimum balance is kept and they can get away with holding very little cash themselves. Some guesses are that they will charge as little as half the user fee. The free market and competition and the law of supply and demand will decide, as they always do in a free market without monopoly power.

If somebody puts it in a term deposit, this is different and here the bank has no reason to charge him anything. They can lend out this money and can charge whatever interest the market allows. With a money like the Gogo without inflation risk 1% should be enough.

The banks get their income from the difference in the interest rate they have to pay and the one they can charge and that is the same with the Gogos.

Now to the business of exchange. There is first the exchange between Gogos and Dollars. This will not amount to very much because the yearly user fee will be applied then right away to discourage such exchanges and if a commercial bank is doing such exchanges the Gogo Society will have to allow a percentage of this fee for handling to the bank.

The same will apply to the exchange on the expire dates. The banks will not have to do it for free, but they will also not be able to charge an arm and a leg for this service or the stores of the members of the society will do it themselves. The amount of Gogos will be very limited and with the expire dates spread out over the year it will be so little that everybody will be amazed. It might be as few as 500 bills a month here in the valley.

It is not the amount of Gogos as much as their faster turnover during a year, which makes the difference. There will be no idle Gogos but the only time they will cause additional work is once a year, when they must be exchanged. Being only a complementary medium of exchange an amount of 10,000 Gogos which means around 5000 bills at the most will circulate in the sunshine valley and surrounding areas as far as 100 km away, but there will not be very many far out in the beginning.

This means that only around 500 bills need to be exchanged every month. This can be done by a single teller in half a day. Or, if the banks do not want to be bothered, any designated store of the alliance can do it also and will gladly do it. Besides the percentage of the user fee it gets, it will see people with Gogos come into the store and some might buy something at the last moment before paying the user fee. It might be prudent for the banks not to tempt them by refusing to do this service.

Fact is that the alliance (or society) will have a bylaw to limit the amount of Gogos issued to that sum for the first year until an extension of the Gogo area might create a larger demand for Gogos.

Considering the small amount of Gogos the actual physical Gogobank could be nothing more than a safety-box at a bank or, again, a strongbox at a member store.