[home] [German] [German 2] [English 2] [links]

Table of contents for English

4) The Law of Supply and Demand

8) Some thoughts about the monetary history of the great depression!

11) Money, its worth, its use and its faults.

12) The pathfinders of the economy!

13) A Critic of Irving Fishers Stamp Scrip

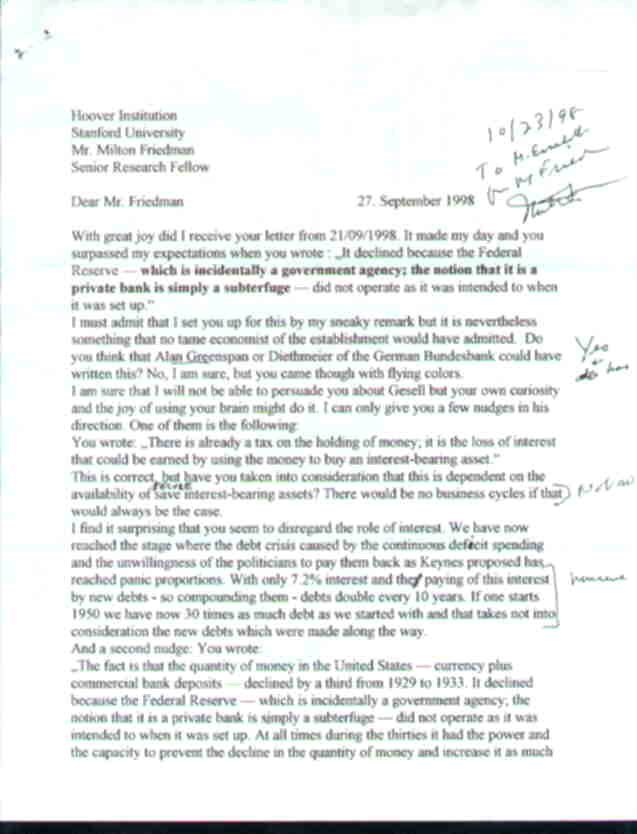

17) Letters to Milton Friedman

20) The scale of the quantity theory

22) The quantity theory of money!

23)What can be learned from the miracle of Woergl - Silvio Gesell's miracle?

Talking about money was put at the start of these English pages because Hans from Canada thinks that it sums up what is tried to do in all of them. Focus on money and its working against the background of the economy, the foundation of human life on this earth.

by Robert Mittelstaedt

One of my associates at my job is constantly talking about money. He's just about buying a new car because his old one is rapidly falling apart. He's running around from one car-seller to the next figuring out what the advantages are of the various brands in relation to the prize. He checks the options the banks offer for taking a loan or whether it would be better to lease a car and so on. Another of my colleagues has accumulated a humble amount of savings and went in shareholding business. He is permanently looking around, considering which stock would be best in order to multiply his money. A third one doesn't want to go through such pains and is dreaming of a big hit in lottery. Every week he ensures to get a new lottery ticket in order not to miss the chance of getting rich with one blow. Most of us normal money users often complain about increasing prizes and rents and about not having enough money, especially towards the end of a month when we desperately wait for our payment of salary.

These are the topics we assume when we "talk about money". But let's have a closer look. Are we really talking about money? Actually we're talking about things we do with money, how to spend it, how to get it or to increase it and so on. As a matter of fact, we never talk about money. It would be just too boring. Talking about money might mean to talk about coins and bills. Everyone knows what a dime, a quarter, a 1-Dollar-bill looks like and talking about these would quickly exhaust our interest. So we resort to topics that we consider more important. Language itself offers an analogous example: we're primarily concerned with the ideas we want to express and usually do not consider the structure, grammar or syntax of our language. Our focus is on content, not on the medium itself. The same applies to money: we focus on content, that is, what we do with money rather than its specific features.

But every medium, through its very construction, gives our perception a certain twist, a tendency. It has a bias which emphasizes the things it is suited for and neglects others. A certain language may be particularly apt for expressing certain ideas and concepts, another language might make it more difficult to communicate the same concepts. Thus language affects our perception, because it emphasizes things that can more easily be put in words. Media shift our attention towards things that they are suited for and lay stress on them. New media therefore, by changing the sense ratio of our perception, are a threat to our conventional way of perceiving and confuse the thinking we are accustomed to. Possible reactions to such threats are as numerous as there are individual human beings.

An analogy as to how we organize our conscious perception might give our eye-sight. The retina in the back of our eye serves as a kind of screen on which the things we see are being projected through the lens in front of our eye. This retina consists of a countless number of nerve cells which are sensitive to light and send their impulses to the brain where all the millions of nervous information data are processed and put together to a picture which we identify as that what we see. In the centre of this retina is a special area which is called the "yellow spot" and this is crammed with more sensitive nerve cells than the rest of the retina. It is the part of our eye which is most sensitive towards visual stimuli. When we concentrate our sight on a particular thing, we automatically turn our eye in such a way, that the thing of our interest will be perceived by this yellow spot. We focus on something while we are only dimly aware of the rest that is being projected on our retina. We may call this our peripheral sight and in terms of our consciousness, these are the contents and impressions that remain on subliminal levels of it. Of course, by turning our eye, anything in our peripheral sight might fall on the yellow spot and thus be focused on. This analogy of our eye-sight gives a rough and partial idea of Wolfgang Köhler's theory of the Gestalt Psychology, the psychology of perception, which was turned to practical use in therapy by Fritz Perls who had his heydays during the seventies at the famous Esalen Institute, California.

A very useful summary of this theory in this context gives Felix Stalder in his article "From Figure / Ground to Actor-Networks: McLuhan and Latour" http://erp.fis.utoronto.ca/~stalder//html/mcluhan_latour.html :

»The figure / ground relationship describes a way in which perception is structured. The figure and the ground together constitute the totality of what is perceivable. However, it is the figure on which perception is focused. The figure is what appears structured, as the foreground and whereas ground appears as unstructured and background. The boundary between the two appears to belong to the figure, that is why the figure has a shape whereas the ground appears to be shapeless. The figure is specific, the ground is generic.

This distinction between that which is perceived and that which is blocked out in order to focus perception is central for McLuhan. A great deal of his work is the result of shifting attention from the area of attention, the figure, to the area of inattention, the ground. McLuhan used different sets of words to describe the figure / ground relationship, for figure he used content, for ground he used environment, or more often, medium. The study of media, then, is the study of ground, the study of the area of inattention. This area of inattention, however, is where the pervasive influence of media unfolds, rather independent in the figures that appear easily visible. His Understanding Media, for example, is by and large the exploration of different grounds as they are structured by media such as Television, radio, print, the car, clothing or money.

The ground, or environment, is not a passive container, but active processes that influence the relationships between all of the elements in it. Shifting attention to the ground, McLuhan found that the ground is not all generic, as it has been thought by the psychologists. The ground is full of differences. Its elements are extremely heterogeneous -- basically everything except what you look at. Most important is that they are related across all categorical distinction. Their relationships ignore preconceived categories that modern science was all about establishing. However, these relationships are not random, but structured by the medium itself. And the restructuring of ground is the most important thing that a new medium does. Hence, the medium itself is the message.«

So, let's aim our yellow spot on money as a medium and its pervasive influence, which has escaped our attention for at least two thousand years, not only that of economists but even of historians as well.

In his chapter on money in UNDERSTANDING MEDIA McLuhan says:

»Money, however, is also a specialist technology like writing; and as writing intensifies the visual aspect of speech and order, and as the clock visually separates time from space, so money separates work from the other social functions. Even today money is a language for translating the work of the farmer into the work of the barber, doctor, engineer, or plumber. As a vast social metaphor, bridge, or translator, money - like writing - speeds up exchange and tightens the bonds of interdependence in any community.«

Viewed in this way, money carries the information of the fruits of the work someone has performed and entitles him now to take the fruits of the work that someone else has done. Money serves as a mediator and if we apply McLuhan's claim that all media are extensions of man, we might say, it extends the human faculty of giving and taking work. Unfortunately this is not the only purpose money can be used for. Money has an invisible advantage over the objects of exchange - it doesn't loose its nominated value. While most goods will rot or rust and gradually loose their value or require special care, i.e. costs, to keep their value like cars or houses which need repair and renovation every now and then, money only requires a safe to put it in - and that's it. In an economy which is based on barter only, a farmer who produces - say - tomatoes and wants apples in exchange, meets the farmer who is willing to give him apples for his tomatoes under the same condition: both want to get rid of their goods before they rot. Under these conditions a fair deal is possible. If money comes in, the whole thing becomes quite different. The owner of money has an advantage over the farmer who produces tomatoes or apples. The farmer has to get rid of his tomatoes before they rot, the owner of money can wait and eventually extort a reduction in prize even below the value of the farmer's work.

This advantage of money over goods, also called 'liquidity', is eventually expressed in the interest rate, which idle money can demand from someone who needs to borrow money. Thus money has two contradictory values: for someone who needs money for his living, it is worth as much as the goods he exchanges for it. For someone, who has got more than he needs, it is worth more, because he can give it as a loan and collect interest. At an interest rate of 3.5% he can double his fortune within 20 years, at an interest rate of 7% within 10 years. This is due to compound interest. Thus, a given fortune grows exponentially.

This schizoid nature of our actual money is responsible for the splitting of society in the wealthy and the poor. The splitting occurs with exponentially growing speed and eventually will collapse. In Germany for instance, private fortune presently amounts over 10 trillion German Marks (i.e. >10'000'000'000'000 DM). Debts also amount almost as high as this (If money would be withdrawn from the market, economy couldn't function, so money has to be pulled back by making debts - which of course cost interest...). The situation is basically the same in all advanced countries. At this point the question arises: who owns all the fortune and who is making the debts to pay interest for?

The answer to this question would be too long with all its differentiations and various aspects, so I just cut it short for now. There is a remedy for our sick money system which has been proposed by a man named Silvio Gesell (a merchant and a disciple of Proudhon) about a hundred years ago. His suggestion was: to put a user fee on idle money that would equal it with the objects of exchange. So, let's really talk about money for a change. On the following pages the reader will find an astonishing multitude of insights on various aspects of Gesell's Free Economy. For the one who understands the social, ecological and cultural implications of this new money order, these insights will inspire a vision of a society that could be free from most of the tribulations from which our world is suffering today.

Look at the poor little one!To whom does this planet belong? Can we find its rightful owners?

The answer seems obvious: to all mankind.

But as long as their money allows them to take advantage of somebody elses

achievements, it is also an instrument for appropriation of land, minerals

and other natural resources. The neutralization of their money's superiority

over the objects of exchange would limit it to the value of human labour.

Money should be understood as the extension of the human faculty to give the fruits

of ones labor and to accept the fruits of other peoples labor in turn without somebody using usury to step between a just exchange, thereby accumulating large sums of it and using it to buy the planet, or parts of it.

To understand how stamp scrip ( or free money as Gesell called it) works we have to look a little bit on the workings of the law of supply and demand, the most basic law of economics.

This age old law states quite simply that the price of a good depends on the relation of supply and the demand for it. P = D divided by supply S. The old economists showed it also in form of a scale.

In the case of money, which is in a economy based on it and on a market with wide-spread division of labor the nearly only form of demand, the formula is stated: P = M/G meaning the price changes with the relation between amount of money in circulation to the supply of goods and labor. This was called the quantity theory of money. It also was shown in form of a scale.

When they found out that money is used over and over again they introduced the concept of turnover into the formula and the formula now looked like this: P = M.V/G with V for velocity. Gesell was one of the first to use this formula and called it the refined quantity theory of money. This also can be shown in form of a scale only now you have to extend the arm of the scale with the pan for money and have the pan movable to show the velocity. The farther out the more speed and angular force and the closer to the pivot of the scale the slower the speed. I am very proud of this scale because it is my invention. (It is shown farther down on the next page.)

Irving Fisher used a slightly different formula. MV = PT. If one asks for the price this formula would look like P = MV/T. The only difference between the formulas is that Irving Fisher takes T for transactions as an already done deal while Gesell and others take G (standing for goods and services as a potential deal taking so into consideration also the "leftovers" like unsold goods (surplus) and unsold services (unemployment). Fishers formula has one less unknown factor but shows only what has happened already while the other formula with an additional unknown factor also shows how the economic forces work, but has to be used as a periodical equation taking into consideration the changing prices of goods and services.

Now the workings of stamp scrip (free money) are maybe easiest understood if you take my scale and think that the tax on idle money pushes the speed of turnover so far out on the arm that the speed only comes to an end when there is no more surplus of goods or services there which money can be exchanged into. Isn’t this what we want? No more unemployment and no more unsold goods. Think about it!

Do not think this would mean an empty market. Production was never a problem and the market would continuously be replenished. It was always the under-consumption which caused the problems of the ages. People hungered not because there was not enough food but for lack of the medium of exchange. People were unemployed not because there was no work. They were unemployed because there was no money to pay them with.

4) The Law of Supply and Demand

1. Everybody, who thinks at all about economics takes it for granted and hardly gives it a second thought. Yet hardly anybody understands how deeply it controls all aspects of the base of human survival, our economy.

2. In the following paragraphs we try to shed some light on it.

The most basic law of economics is the law of supply and demand. Very simply it states that the price of some good changes in relation to the supply of it and the demand for it. That is all!

Expressed as a mathematical formula it is stated: Price equals demand divided by supply. The classic economists showed it in form of a scale:

Instead of demand one can use money and then you have the so-called Quantity theory of money.

There is only one thing missing. The old economists did not think that money is not only used once like most goods on the supply side of the scale but over and over again therefore the formula should correctly be: The price equal

's money times turnover divided by the supply.This can also be shown as a scale:

The sides are switched over here and the money or demand side of the scale is

mounted moveable on one arm of the scale to show the turnover. ( The proportions are not correct. The arm on the money or demand side should be much longer.)Before we go any further lets first explain this scale in more detail: P is the price and it moves to minus or plus depending on the forces in the two pans of the scales and the position of the money pan on the sliding turnover scale.

Now a few examples: Let's take cherries! A good harvest, which means a big supply will lower the price. Nevertheless, there is now a counter force: with lower prices more people will decide to spend more of their income on cherries - so demand will increase until a new level of price is found. There are also some long range results: If prices are lower than costs cherry trees will get chopped down or on the other hand, if prices allow a good living for the owner of a cherry orchard he will plant more trees, by that increasing the supply.

The price of cherries will stabilize if people decide to spend some more of their income on cherries. It does not matter wether they need or want cherries. Need or wanting cannot be equated with demand. Demand in a modern economy is only demand when it is backed by the willingness to spend money for something or at least the acceptance of the responsibility to pay back the therefore occurred debt.

Now, of course, one can increase the demand for cherries if he can persuade people that cherries are good for their health or that they live longer if they drink lots of cherry brandy and that is the reason for all adverticing: Keep the demand high enough that the pressure of the law of supply and demand cannot push the price of a good below the line where producing it is not profitable anymore.

Still, if you now believe, that cherries are a necessity in your life, you might have to forego other expenses to stay in the frame of your income. If you do it, that puts more pressure on the demand side of the goods you did not buy.

Every economic decision on your part is the cause of some effect in the gigantic interrelation system of economics - and all of it is governed by the law of supply and demand. In other words: All prices are subject to the law of supply and demand, and everything has a price.

The price of labor is usually called wages. The price of borrowing money is called interest and the price of money is what one can buy with it.

Now let

's play a little bit with words and definitions: there is a saying that the best things in life are free - for instance air - which means air has no price. Why not? Take our equation and when you ask for the price, for example, of air you will see that the dominator demand is of limited size - you have to take only one breath at a time after all. The numerator on the other hand is for all practical purposes infinite and when you divide one side of an equation by an infinite number you get a big fat zero on the other side.This, dear reader, is about all the mathematics you will need - usually the scale and common sense will show you what influence on the price certain actions of the players in the economic game will have. There is only one instance when the law of supply and demand gets bent out of shape in the short run and that is in case of a monopoly.

5) Monopoly.

What is a monopoly? The definition in my dictionary reads:" The possession or assumption of anything to the exclusion of others.

" A true monopoly in true life is a rare bird indeed and we would not have to be concerned about it, but the exclusion of others is another thing. Every exclusion of others puts a kink in the free play of economical forces. In a free market a monopoly would be a very short-lived phenomenon and could not even get started if forces outside of the economy would not lend a helping hand. The competition would tear apart a would-be monopolists dream.Something else is the uncounted partial monopolies. They also could not survive a free market but are now so entrenched in the tapestry of our society that nobody realizes what bad influence they have. They block the free competition and distort the real price of everything. What could have been easily adjusted by a little productive effort now becomes an eternal bellyache. An example is rent control that prolongs the scarcity of rental space for ever and ever.

Understanding it might be easier if one thinks of a monopoly - partial, like in a trust, or union shop, or guild, or any licenced trade - or absolute, like in Government monopolies not as a thing but as an absence of something - the absence of free competition.

Not every monopoly is a bad thing as such. Nobody would like to live in a completely lawless society and a government has its uses as long as it keeps its sticky fingers out of the economy. Patent rights, which are a monopoly too, make sense for a short period of time. 16 years seems just right. By that time the owner of a patent should have made enough money and should have recouped his startup losses. He would also still be ahead of the competition because of his

"hands on " experience. What more can he ask? Copyright is also a monopoly and the law as it is now may be just right. A man should have the right to his own mind and labor, but only as long as he or his first heirs are alive.Land ownership also is a monopoly as it excludes others from the use of the land even if it isn't used by the owner. The solution to this problem is simple. Tax the land and not the improvements. Not an outrageous percentage. One per cent should be plenty and one could even let the owner set the price of his land. Only in case of an expropriation this would be the price he would get. That would prevent him from setting to low a price on his land. On the other side, if he puts an unrealistically high price on his land, he would have to pay higher taxes.

The price of land like as other prices of goods and services is governed by the law of supply and demand which means: Land without people is worthless and if more people need and want land and are willing to pay for it, then and only then will the price of land rise. Land as such has no intrinsic value but because it can

't be increased it lends itself to blackmail by the owners. They know that other people are dependend on the use of it. Therefore a tax system that would tax away the unearned increase in price would be just.All other goods can be increased in quantity if the demand warrants it and are actually quite often worthless to the temporary owner. What use are 100 pairs of shoes to a shoemaker for instance? He can only hope that they have a retail value. If they have that, fine, then he can sell them - hopefully with a profit. Nevertheless, he has to sell them, and wether he makes a profit or not. The people, who have temporarily the ownership of money know or feel this and unless they are barefoot in winter they wont let him get away with outrageous profits.

No sane man will produce shoes, of course, if he cannot expect a price on the open market that will pay him back for his outlays and his labor . . . and that takes care of the Marxist theory that the value of a good depends on the average hours of work, that are necessary to produce it. What nonsense! A good is worth, what somebody is willing to pay for it. So even when all the good communists work endless hours to produce - lets say pots and pans and other useful things - if there is no market for them, they are worthless.

So yes, even taking into consideration that only a planed economy consistently produces things that have no market and a producer in a free market economy does so to his own peril and usually not very long it still means it is guesswork. Yes, the shoemaker knows that he can make shoes better and cheaper as the guy who wants to be self-sufficient and makes his own, but there might be a factory in the next town, which will underbid him and all of them can only hope that the law of supply and demand will allow them a price that will cover their costs. Sometimes it does not.

With money - remember that is part of the demand side in our equation - there are also some monopolies involved. First, there is the privilege of printing it. That is a clear monopoly, but there is also a second hidden one. The temporary owner of money can hold it back and can so prevent the exchange of goods until his demands are met. That is the monopoly to strike. The strike of money is a much stronger force as a strike by workers. Money does not have to eat and can wait indefinitely until its demands are met. In former times, when money was equated with gold ( or silver) this had some far-reaching results, like the demise of the Roman empire, the stagnation of the middle ages and probably the fall and rise of untold civilizations.

Now, of course, we just print more money instead of the one that is on strike, but if one looks back in history, the time of gold backed currency is not so long gone. Even now somebody can get a Nobel price in economics, who promotes a gold standard. As short a time ago as 1907 a single banker ( Morgan) could plunge the world into a depression resulting afterwards in world war one.

Of course, the printing of money does not solve the problem either. What happens when the people who held back their money, which was replaced by the newly printed one now decide to go back into the market and ask for goods?

New and old moneys compete for goods with the result that there are not enough goods for the money - one could also say that there is to much money now, which means - inflation.

Now lets apply our knowledge to the stock exchange. Here we have a good example of the psychologic workings of the law of supply and demand. The price of a stock goes up if more people want to buy it and it goes down if there are more sellers than buyers. As simple as that! Wether a stock certificate is worth the paper it is printed on or not does not really matter as long as there are people who believe that a stock is worth their money. When enough people buy a stock and the price of it starts to go up it adds to the psychological pressure to buy before it goes up still higher and the potential sellers are in no rush to get rid of their so nicely rising stocks. It means that there is hardly any supply available, while on the other hand investors scramble to get on the band wagon of a rising stock by that increasing the demand.

Some stocks, of course, pay dividends but the earnings are usually far below the ones one can get in a term deposit and there you do not have to take the chance to lose part or the entire principal. The fact that there is a dividend sometimes enhances the value of a stock but cannot be the reason for investors to buy it. They would be much better off putting their money into a bank account. No, it is a gamble, plain and simple and even if you know how it works, there will always be the inside traders, who will skim off the profits of these countless pyramid schemes.

Now let's try out our new perception on an old story.Surely you all know the story of Joseph in the Old Testament. Remember that he was sold by his brothers to some traveling traders. What does this presuppose? First that there was a society that used money and had essentially free trade across the boarders. Secondly there must have been some division of labor or the traders would not have goods for which to trade. On the other hand there must have been a recession or the brothers would probably not have sold their brother into slavery. Joseph must also have had some education or he would not have risen in the service of the Pharaoh so fast.

For us the most relevant part of Joseph

's story is how he made the Pharaoh so powerful. Remember that the Pharaoh dreamed about the seven fat cows that were later eaten by the seven thin ones. That was thanks to Joseph a self fulfilling prophecy of seven good years followed by seven bad years. How did Joseph do it?Read it in the bible! First he brought all the money together in the house of Pharaoh. What did this cause? With little money available on the market the farmers could not sell their produce and as they were already in a stage of economic progress where the division of labor made a medium of exchange a necessity they could not go back to bartering either. Sitting on a not saleable harvest they, of course curtailed their production. Most of the previous harvest they had sold to Joseph at rock bottom prices. Remember, most of the money was in the house of Pharaoh, therefore the law of supply and demand forced the prices down. ( Less money = lower prices, more money = higher prices).

The bible never tells exactly when in the proposed 14 years what happened, but is quite clear in a general way what happened next. Next year ( or later ) the farmers had to give all of their livestock in exchange for bread and later they had to give up their land and became serfs to the Pharaoh who afterwards let them have 80% of what they produced. All this times the preachers were exempt as the bible states a few times. They must have made a killing on the backs of the farmers and were so an excellent guard for the Pharaoh.

Joseph

's brothers, the Jews, got quite a revenge for selling him. They could now supply most of the workforce to build the pyramids.Actually the Pharaoh was quite generous. He only took 20 %. A modern government takes much more . . .

6) Money!

So far we have barely touched the role of money in the economy and that without a medium of exchange division of labor is impossible and that without division of labor civilization is impossible and not only that - the very life of 80 % of humankind would be impossible because for self-sufficient hunters and gatherers there is not even room enough. So we better learn how money works better than the hit and miss approach used so far even in the highest economic circles.

Money is on the demand side of our equation. In fact money times turnover IS demand in a market economy. And why is money a necessity to the division of labor? Simply because there is no other possible way to find an honest and for both sides of a deal agreeable price of a good or service. The only way to a fair price is the bidding in a free market and money is our ballot paper with which we vote day for day what and to what price goods will be produced and services will be offered.

The piece of paper or the coin that is the agreed upon medium of exchange makes it possible that someone can improve his skills of production and can even build and invent machines that will enable him to produce ever more. Doing so without a simple means of exchanging his personal overproduction for the work of others would be senseless for him.

Without a generally accepted medium of exchange and a free market nobody would know the real value of a good or service and the only way of production would be forced labor - in other words slavery. Not that there can be any slavery in a society with a more or less functioning money system or is it not that when you let yourself be brainwashed into buying a fancy house on credit and then spend the rest of your life as a slave to your mortgage....

The Marxists thought originally that they could have a functioning economy and even a more humane one without money. From everybody to his ability and to everybody for his need was the slogan. They did not ask who will decide what anybodies needs are and do the able ones have to work themselves to death for the unable or just lazy ones? In short, our Russian friends tried right after the Communists came to power to get rid of the money. How? They simply printed so much that it nearly became worthless but they still expected the farmers to sell their produce for the now worthless money. Yet how could they? They also needed some goods and there were none to be had for this money. So they refused to sell and were - after millions of people died of hunger in a country that once was the bread basket of Europe - forcible expropriated.

Later the state took over everything, decreed prices for all goods, reduced the amount of money he gave the workers in this paradise of the working man and could even with excessive force not prevent a black market.

The existence of a black market, which is actually a free market in spite of a brutally oppressive regime shows that the market forces are nearly irresistible and are better taken into consideration in all economic decisions

.We should know by now that one just cannot print money indiscriminately and still expect that it will keep its worth. What else can we do? Back to Gold or Silver as currency standards? Some economists really propose this but that would open the doors to a depression that would make the great depression of the thirties look like children

s play and would surely destroy our civilization. Would you want to give a to- days Pharaoh the tools in hand to do unto us as the old Pharaoh did to the Egyptians?Let us find out, who decides today how much money gets printed. Ask the question and you will get a surprising answer. Nobody and everybody! If you or anybody else wants to borrow money and you are an acceptable risk every bank will give it to you. They are in the business of lending money and usually lend as much as the traffic will bear. Now, if they have not enough cash on hand they simply go to the Federal Reserve or whatever the money issuing National bank is called and in turn borrow some money there. If they have not got it either - they print it! . Now you or I might have some reason to borrow money short term and will be very careful about it, because we will think, that we have to pay it back. The government on the other hand has no such scruples and it can borrow money just as well

.Of course, most of the time they try to keep a lid on excessive printing and raise the bank rate to curtail borrowing. ( I use the word printing here instead of

" expansion of the money supply," which a real economist would use because I do not want to confuse you by using the word supply on the money side. Remember: money is demand.)Nevertheless, there are two sides to this. On the one hand makes the higher bank rate borrowing less attractive and on the other hand finds the higher cost of borrowing its way into the economy and forces prices up. This push and pull at the same time account in part for the unholy mess in which the currencies of most countries are.

A high bank rate is often excused by the imagined necessity of keeping the value of a currency against other currencies up. This is nonsense! The exchange rate of one currency with another is also a price, which is governed by the law of supply and demand. Over time the decisive factor is the inner value of a currency, which means what you can buy for it.

Let us play a mind game, which I found useful to clear up misconceptions in my mind. Exaggeration! We assume that goods in one country cost only half what they cost in a neighbor country, jet their currencies exchange one to one. What will happen? At first the citizens of the country with the more expensive goods will flock into the other country and will buy what they can get their hands on by that increasing the demand for the cheaper country

's currency. This demand will force the price of the cheaper country's currency up, until it is not profitable anymore to buy in the cheaper country because the exchange rate expresses now the real parity of inner values: about one to two.Currency speculation is usually allowing for all this and yes... In a circumspect way could an increase in the bank rate bolster the worth of a currency. When speculants think that the higher bank rate will curb inflation by decreasing the amount of money in circulation they will act on that assumption and - presto - for a short time one currency is worth more by a quarter point. Until the cost of high interest rates forces prices up and higher prices means money is worth less and that is - inflation.

You see now that the government or the National bank has no real control over the circulation of money. The control over the speed of turnover is completely left to the public and even the printing of money and the amount in circulation is barely regulated. Horrible as it is - we are sitting in a rudderless boat.

As long as there was a gold standard, gold through its rarity kept a lid on inflation but favored instead the even more destructive deflation and the boom and bust cycles. One could say that gold was the reason for the stagnation of the time between classical Greece and the reformation when a new influx of gold from America brought an upswing to the world economy.

The Gothic timeDuring all this time there was only a short interlude of relative prosperity. That was the Gothic time when all the gothic domes were built in Europe. Yet so short was the time in which as an aside printing and pocket watches were invented that nearly all of the domes were left unfinished. They were all originally planned with two large steeples on one side and a smaller one on the opposite side. When the moneys run out they had to hurriedly cap the half-finished towers or abandon one or even all of the planned three towers. Go to Europe and look at these witnesses of stone and remember that they were built not by slave labor but by well paid guild members and mostly from their donations.

Remember also that most of these churches were built in towns with less than 10,000 inhabitants. Do not think that those people were over worked. They had a free Monday for bathing. Sunday was a day of rest and attendance in church. There was also an abundance of church holidays, where nobody worked. What had happened? What was the reason for this surprising wealth?

The church then did not allow its members to charge interest for lending money. They called it usury. Therefore, people kept their spare cash hidden. This caused of course, widespread scarcity of circulating money and as we know that means falling prices and economic stagnation. As an aside: Jews were not bound by this rules and as most other professions were forbidden to them were forced to become bankers.

The lack of circulating money did not only hurt farmers and tradesmen but also the rulers. So they started to mint their coins thinner and thinner and started to call them back for re-minting on a fairly regular basis . Whenever they exchanged them for new coin they charged for re-minting as the weight of the coins was later prescribed by law.

What happened now? The money was forced into the market and business started to bloom. Nobody wanted to keep spare cash around - it would be worth less with the next re-minting. Now the priest harassed the steadily wealthier trades people and as they could afford it they started to build the gothic domes.

We will not dwell on the crusades which also happened at the end of that time - with our new insights this is the work of generations of historians, but will continue with the main trend of the history.

As it always happens when government has a good thing going, they soon overdid it with the re-minting and that caused quite an inflation and people clamored for better coins. After a while they got them and, presto, deflation, no more spare cash for churches, the knights became robbers, the farmers became slaves and nobody knew what hit them...

,Most of this you have to read between the lines in the history books and it would be a worthwhile effort for generations of historians with our new insights into the workings of economy to rewrite these books. Then we could learn something from history. So far there was only one historian who made a start at it: Fritz Schwarz, Segen und Fluch des Geldes in der Geschichte der Voelker.

Isn

't the world a crazy place? Only because some ruler needed more money ( He was Bishop of Magdeburg ) and found an innovative way to do it within the framework of existing laws were these beautiful churches built. And because lots of other small rulers followed his example were medieval towns and castles built.People did not realize a good thing when they saw it and the rulers were too greedy and did not know what they were doing in the first place. That is why centuries of misery followed this short spring of the gothic age.

There is one riddle left in the story of the gothic domes. How could so few people without machinery as we have now build this domes and finance them? Remember they had no machines for other things either and had to do everything by hand. They could afford the luxury churches only after they provided for all necessities and a few other luxuries. Remember the free Monday for bathing. Some priests complained about that. They did not like it that both sexes bathed together nude in the bathhouses. Nevertheless, had this sinful people an open hand for their churches. We can assume that the rule about usury of the Roman Catholic Church had something to do with it. People were not allowed to collect interest but they did not have to pay any either. Therefore there was hardly any unearned income and the working man enjoyed a higher percentage of the fruits of his labor. So much more that he was even willing to donate it for a church. His effort went into the building of a church instead of the feeding of parasites. And this leads us to the role of interest in our economy.

7) Interest.

We touched the subject of interest briefly in previous paragraphs but did not get around to a really deep look. What is interest? Interest is the price one pays for borrowing money and what one gets for lending money. Who decides how high the interest should be? We like to believe that the National Bank or in the U.S. the Federal Reserve does this. That is only partly correct. The price of borrowing money like any other price is governed by the law of supply and demand. If many people want or need to borrow money then the interest rate goes up. On the other hand if there is lots of money around looking for borrowers, the interest rate goes down.

It might be quite interesting to find out how interest comes to be paid in the first place and why historically there was always a market situation that allowed the collecting of interest. We won

't go into this now because that would fill a book of its own. It is enough to know that the people who built the Gothic domes already showed us how to get rid of the interest and that is enough. We only have to find out if doing something about it is really necessary.First let us explain on hand of an example that eternal interest is impossible. The example only slightly changed is from the book of an old friend: Otto Valentin " Die Ueberwindung des Totalitarismus,

" to whom I am also indebted for an in depth explanation of monopolies.I will not use the different currencies through the ages but simply start with the equivalent of one cubic millimeter of gold. It is invested at the time of the birth of Christ at a rate of 7.2% that is quite conservative at to days rates. I took this rate because it just doubles the principal with compound interest in ten years, give or take a few Cents. This simplifies our calculation. In the year 10 we would also have two cubes.

Now it starts to double every 10 years. One 2,4,8,16,32 and so on. In the year 100 we have already one cubic centimeter, in the year 300 A.D. a cubic meter and than it really starts growing: one cubic kilometer in 600 A.D. and the pile of gold keeps growing until it reaches the mass of our earth in the late twelfth century and somewhere in the 15. centuries the mass of the sun.

Obviously, this is impossible but on the other side is it a fact that interest at a rate that is not much less than the seven percent gets paid since ancient times. Our example only shows that the sums involved are gigantic and it is curious who pays all this interest. Somebody has to pay it because nobody would be so crazy to lend his money free of charge when he can get interest. Nobody would invest his money into something that would not promise even more return. There are after all more risks involved.

Hold it! Does this mean that every good in this world has to be paid interest? The machines, the factories, the merchandise in the stores of the businessmen, everything? It seems so. What does this mean? It means that every good in this world has to be paid within 10 years ( 7 percent interest assumed) to the interest takers all over again. All together quite a tidy sum! No wonder that the beneficiaries of this system fight tooth and nail for their privileges.

Some people could not care less because they think that they get more interest as they pay but they never realize that they pay interest in the price of everything they buy. The businessmen and the producers have to recoup the interest they pay in their prices The Government owes money and it has to recoup the interest it has to pay in your taxes.

Nobody can add all this up correctly because one never gets the real numbers but a good guess would be that 90 % of the average income from labor ( A businessman works too ) goes for interest and taxes. Interest including the interest that the government pays amounts to the Lions

share of that.But even that would still be acceptable if it were not for the fact that the strike of money sets in whenever the interest sinks below a certain mark ( historically around 3 percent) thus preventing general wealth by causing unemployment and business disruption. This is probably not caused by a world wide conspiracy even if it looks like it sometimes, No, it is inherent in the form of our money that has an impossible dual character. On the one side it is a medium of exchange and on the other side a medium to store wealth. Both of this attributes are mutually incompatible. Whenever one uses it to store wealth, he pulls it out of the market where it is supposed to make the exchange of goods possible. That mankind survived this mess for thousands of years is due to the fact that one can be self-sufficient and only barter his surplus. Mankind survived but many civilizations did not.

Our own civilization is now tethering on the brink of destruction and it will collapse if we do not change our money system and make land available to the people who will work it. Doing this will also get rid of most of the government bureaucracy. What else is government doing than trying to keep the workers docile and redistribute some of the unearned wealth of the " capitalists .

"The government does not do a very good job anyway and most of the redistribution ends up in the salaries of our public servants or worse in the pockets of some third country despots. When Labor gets his full price the bureaucrats are superfluous and we can pension them off.

Now let us repeat what we learned so far even for the danger of repeating over and over again things that should be common knowledge. Without money there is no division of labor! Without division of labor there is no civilization! Without civilization about 90% of the worlds population would die because they could not produce and gather enough food to survive. Why was America nearly empty when the white man came? The Indians had no money! That's why!What happened to the ancient civilizations? In the first place, they had money, usually as gold or silver coins, or there would not have been a civilization. Usually they robbed gold or silver from some other more primitive countries, then minted it and got the economy going in this way. Later with interest dividing their own

population into interest-takers and interest-payers and the following internal fights money, that is gold, disappeared from the economy. A good part of the Roman gold disappeared into India for spices. The ( not so ) wise king Salomon put gold into the temples and even adorned a tree with it. Gold, in this case the coins, which were money, disappeared from the market and you should know by nom, what was the result. More goods chasing the elusive coins means after the law of supply and demand that the prices of goods had to fall thereby making commerce impossible because everybody was waiting for goods still to became cheaper. That was bad luck, of course, and they still did not know, what hit them. But do we?...

Let us go back to the Gothic times once more.

We know that the rulers re-minted the coins quite often and charged a much to high price for this service. The result was a speeding up of the turnover to a point where the fact that the money had to change hands brought the speed to a natural limit. It is beside the point that they overdid it which in the end caused people to balk. In any case, have a look at our scale. With the turnover hitting a natural limit, we have now all known factors in our equation. Imagine the pan with the money at a more or less stable endpoint. As in Gothic times less money now moves more goods if we put a similar tax on idle money.

What would follow? With the turnover a more or less stable number we can control the money side of our equation. The goods and services side is such a slow changing number that we do not have to think about it at all. The amount of money is also an exact number, controlled down to the last Cent. How much there is and what denominations is a matter of record. And the average price? That is easily measured by an index .In Gothic times, of course, they did not have an index and had no easy way to control the money in circulation, but we should have no problems.

The moment, we make the political decision to stabilize our currency we can do it. ( Germany did it after World War one and two without gold).

With a more or less fixed rate of turnover, if we use something like the re-minting of coins as they did in Gothic times we only have to control the amount of money. That is easily done! We could have a stable currency and all we need is a printing press and a furnace.

The moment prices, measured by an index, go down, we would print more money. If prices go up, we would burn some. The charge for re-issuing money would give us enough leeway to do so. And the charge has to be regardless of the cost for new paper. It has to be, to take the power to strike away from money. It has the power to strike now only because opposite goods and services it has an inherent superiority - it does not rust or deteriorate and neither does it go out of fashion and it does not need to eat. When you take away this superiority you start with an honest competition.

How high would this charge have to be? Easily answered! Just as high as the interest is now, that money can blackmail out of the economy! Three to six percent!.

Yes, the interest rate this days might be higher, but this is only because there is an inflation and risk premium on top of the basic rate.

Now we have it! The solution to our economic woes is so simple that it is hard to believe and our economists won

't hesitate to tell you that only a simple-minded ignoramus could believe in it. What about the book-money they will cry and the transfer of money on accounts without the use of cash?First, what is book money? Simple answer. Book-money is credit on a bankbook or account! And transfer from one account to another is movement of credit ultimately dependant on availability of cash. Or in other words - turnover! Just as with cash there is a natural limit to the speed of it. What do you think the banks will do when it costs them money to keep cash on hand? Remember they will also have to pay exchange-charge or idle money tax, whatever you want to call it. They will roll over this charge on the short term accounts, which means they will charge you for the save keeping of you money and by so doing will force this accounts into circulation. What else? More questions? Will the whole world have to a accept this new money at once? It would help but isn

't really necessary. All we need is for one country or even one region to adopt the new money. Just as the other rulers in gothic times followed the example of one innovator other countries will follow the example of the country which first introduces it. Success is after all very persuasive.

So, what if.

What would happen if a small country, only just big enough to have a currency of its own would change to our proposed money? At first, it is sure that the other countries would not trust this newfangled money and even the people inside the country would have doubts. For that reason not many people would ask for this money therefore keeping it undervalued. Remember the law of supply and demand! But there is also another law of economics.

It is called Gresham

's law and it says that bad money drives the good money out of the market. This is easily understood. People save the money that they conceive to be of higher value and try to get rid of the "bad" money. In this case the "bad" money is the one that gets taxed when it stays idle.Therefore our new money will drive everything else that might be used as medium of exchange like gold or foreign currencies very fast out of the market place. Only much later, when people will realize that the new money keeps its value, while everything else including gold will steadily be less worth, will they use it as a short time medium for savings.

Gold derives its value mainly because it is used as the basis of currencies and if mankind did something more stupid, than digging out the stuff and fighting endless wars over it, only to dig it in again in Ft,Knox, it is hard to imagine. Mind you, gold has some value, but it is not rarity that gives it value. Rarity as such is never the cause for a high price, it is the usability and the general acceptance, that accounts for the value of a good. If you think that rarity alone gives something value, then try to sell the one of a kind white elephant

Gold has its uses in dentistry and if it would be cheap enough one could probably find some uses for it in electric circuits. Jewelry comes to mind as another use, but here the conceived value is bound up in the age-old mystery of gold as a precious metal. But let us go back to our small country and the new money.

With the undervalued currency the goods of this country would be cheap in terms of other currencies and a holiday in this country would be a bargain for tourists from abroad. The undervalued currency would act like an export-premium but slowly things would even out. Especially when people would notice that their own money would keep its internal value, while the other currencies would still be in the throws of inflation.

Slowly the tide would turn. Now investors from other countries with an unstable currency would bring their money into the country with the stable money and would even take a lower interest rate in exchange for safety from inflation. The surplus capital would lower the interest rate even more. This is again a result of the law of supply and demand. The low interest would make investments profitable, which would have been impossible to finance before. You have no phantasy if you can not imagine what is possible with an interest rate of close to zero. Put the whole of the Rockies under glass to grow food. Computerize all manual work and allow all citizens a life of leisure. You name it and you can have it.

But remember one thing. Interest is the price of borrowing money and like all other prices is subject to the law of supply and demand. You can not just degree: No interest! First there has to be an abundance of capital which means: as long as there is a scarcity of real capital like factories, houses, machines that are still able to command interest above amortization money will look for this investments and won

't take much less for the sake of liquidity. As long as land-rent is not taxed away money, of course, could also flee into land-ownership.Examples for that are Swiss bank accounts that pay no interest and even charge one for safekeeping . Or the interest one could get in a Mexican bank a few years back. 35%! That was at a time when the exchange rate Mexican Peso and American Dollar was for years quite stable and many American snowbirds got caught by this bargain. Who would have thought that the Mexican Peso whose exchange rate was 1 to 15 for years would drop to 1 to 500 in a short time?

There is no free ride unless one counts profiting from a monopoly as such. But even there the free ride is only temporarely free. Sooner or later will the black-mailees revolt and then even such an all including monopoly as a communist state will topple.

Every monopoly has the seed of destruction already in it. Competition by other

"would be" suppliers of the same goods and services or the production of "Ersatz" articles or changes in the buying habits would put an end to them. For instance, what value would the tobacco or alcohol monopoly have in a country of non-smokers and non-drinkers?Only one thing keeps them alive and well. That is the aiding and abetting role of the most basic of monopolies in the economy - the ability to strike inherent in our money.

The sorry result of all the revolutions and wars in the history of the world is that none of them ever touched the real cause of all the misery. None of the religions could end the eternal fight between interest-takers and interest-payers. And after every war or revolution the same old division between rich and poor started anew.

After every destruction of capital goods caused by a war capital was scarce and could demand fairly high interest. There was a lot of work to rebuild the destroyed houses and factories but after awhile as more and more capital goods started to compete with each other and profits started to shrink and soon the money pulled out of these now unprofitable investments. The strike of money set in!

With gold or silver as money - that was it! Depression, sometimes for centuries until some imperialistic war brought new money into the victorious country

's economy. They simply robbed it from the losing country. History called the ruler of the victorious country afterwards "the Great". Alexander the Great, Charles the Great and so on.Now, of course, in the age of paper money, we found another solution. When money starts to strike we just print more - in this way causing inflation which forces the money back into the market. So far so good, but now we have another problem. To begin with, interest adjusts to the new situation and lenders add an inflation premium to the interest charge and they get it too because most borrowers usually have other debts to service and the lack of demand for their goods and the lack of cash flow forces them into more borrowing. One of the worst offenders in this case is usually the government itself where the politicians always promise more than they can provide.

The overly high interest rates make it very difficult for genuine long range investments and the only people besides the government who can afford the high rates are the pyramid-scheme-artists. But pyramid-schemes are bound to collapse. Sooner or later reality catches up to them and they run out of suckers.

But some pyramid-schemes work well for the instigators. How do they work? They always involve unwary investors who still believe in a free ride and as long as new money flows into the scheme some people even make profits, which they usually re-invest because they are on to a

"sure" thing. When the inevitable collapse comes will the instigators have long pulled out and usually have disappeared with the loot. This run of the mill kind of pyramid-scheme is quite common and not to hard to spot. But there was a neat one a few years back and laws of libel prevent the naming of names and places. Now to the story. It was a time when money was quite loose and banks lent money left and right to some very shaky customers like unstable third world countries. The developer who introduced the scheme got hold of some run-down city block. He paid a low down payment had it financed by a bank and sold it right away to a company where he was the main stockholder for ten times the amount. One bank gladly financed the deal with 90%. After all, they thought, if somebody is willing to pay so much for this land it is probably worth it. In short after flipping back and forth the same property for ever more inflated prices, having milked his companies for all the profits out of this deals he let the last company declare bankruptcy and one bank ended up with a worthless piece of property and hundred of millions outstanding not collectable debts. And if you think now, good for the developer, think twice, the banks have the power and take their losses out of your hide.... You already paid for their losses to the third world countries.But back to the original theme. We wanted to know what if. We already introduced the new money, which similar to the gothic bracteata prevents hoarding and have only go down to the nuts and bolts of it. One of the ways is quite simple and was used in modern times in Woergl. Their "money

" had fields on the backside, where one had to paste stamps, which one had to buy from the town cashier and which cost every month 1% of the face value of the bill. One percent per month was quite high but nobody complained about it in the 14 months this money was in circulation. The Austrian National bank, of course, did not like the competition and was suing the Mayor and the aldermen who had introduced this "money". But it took them more than a year to kill the idea. More than 200 other villages and town were ready to use this new money also, because of what had happened in Woergl, where it circulated freely and at least ten times as fast as the government money. With the towns money to 100% backed by government money in one year the town had paved the main roads, built a bridge and a ski-jump and introduced streetlights. In the middle of depression people were working and all with the help of a few hundred Dollars worth of "Ersatz"money.The economists in the universities did not like the experiment of Woergl at all and one of them wrote a book against it. Quite shamelessly did he equate this money that was circulating 1931/2 in a time of depression with other

"Ersatz" monies which were used right after world war one during a time of galloping inflation because the government could not keep up with printing money. That is not the same thing at all....One could probably find other ways to tax the idle money. One that was proposed was to put money in circulation with four different colors and let lotteries decide

which color will be pulled out of circulation with a cost of 2% instead of the half percent which would be necessary when the whole currency would be exchanged. A neat solution, which should work quite well and would be cheaper and more

elegant than stamp script as proposed by Irving Fisher. But on the other side, the psychological impact of licking some stamps to put on your money might also be worth it.

,

8) Some thoughts about the monetary history of the great depression!

The chart on page 302 of Milton Friedman’s Monetary History shows that the amount of cash held by the public actually increased during the great depression 1929 to 1933.

Held is the operative word! The currency was not circulating! This shows clearly that the velocity of money plays the pivotal role in the business cycles. The velocity can change much faster than the amount of currency. Therefor the actual amount of money in circulation (I hesitate to use this word) is of secondary importance. Money held in hoards is not in circulation at all and can therefor move no goods. But even a hesitancy to spend money because one expects lower prices during a business slow down reduces the velocity and that forces prices still farther down. A downward spiral begins which is hard to stop.

The same self-feeding process can happen the other way also when to much money is put into circulation. Then the velocity increases and prices go up. Everybody buys before prices go up more and that speeds up the velocity still more and so on. This is the simple explanation of the way business cycles feed on themselves.

The only way to have stable money without inflation or deflation is by getting some control over the velocity of turnover.

During a time of deflation Irving Fisher following the lead of Silvio Gesell and John Maynard Keynes proposed different means to get the stagnant money moving again. Irving Fishers and Silvio Gesells proposals were never put to widespread use but Maynard Keynes’ one was. His proposal was to jump-start the economy by deficit spending and then reduce the deficit during the following good business.

His proposal worked after a fashion and we can thank him for preventing with it a mayor depression for over sixty years. Without it depressions usually follow in time-spans of about 25 to 30 years.

But he put to much trust into the politicians when he expected them to pay back the deficit. They never did. In the opposite, they paid even the interest on the debt

only with new debts. Therefor we are now saddled with debts which can never be paid. We are on the end of the road on which Keynes has lead us and we should better have a second look at the solutions which were proposed by Irving Fisher and Silvio Gesell and which were abandoned in favor of Keynes’.The main difference in their proposal was that they wanted to apply the moving force directly on idle money and not indirectly by inflatory pressure. This was a totally new concept and was besides a few minor experiments more or less accidentally used to a larger extent only for nearly 300 years during the middle ages. The ancient Egypts also used in their greatest time a unhoardable money. Deposit marks for grain made out of clay.

Both wanted to use a tax on idle money in a form of stamp scrip where stamps had to be applied to keep the money legal tender.

The only difference between Irving Fisher and Gesell was the amount of this Tax. Gesell proposed a Tax of 5.2% a year in weekly stamps of 1/1000 of the nominal worth and Keynes thought that even this was to high and left the actual percentage open in his Bancor proposal and disregarded it completely for normal money stock replacing it by slight inflation caused by deficit spending. Gesell himself had later changed his difficult to implement proposal to a more realistic one of 1% every two months.

Irving Fisher asked for an impossible 104% a year in weekly installments of 2%. It had therefor no chance to be used. The small experiments with this money in Germany and Austria which had caught his attention used a tax of 1% a month, 12% for the year (much closer to Gesells original numbers) and were therefor accepted by the public and were working until they were forbidden on the grounds that they infringe on the monopoly of the Central Bank. This way the experiment of Woergl was killed to save the deflatory policy of the Austrian Central Bank.

Now 66 Years after the experiment of Woergl or the miracle of Woergl as it was called we are just as far away as then to test this technique of control of turnover, if not even farther. Then we had at least two well-known economists looking into it. Now there is none.

Since the war there was no pressing need for a way to speed up the circulation of money because inflation took care of that. Only now when the debts caused by this policy become really troublesome and nobody sees a way out and one country after another has a debt crisis are people asking for a way out and if economic science cannot find one, then self help groups will have to do it.

Now we know that the cumbersome stamp scripts are not necessary and a simple replacement of dated bills once a year will do it just as well in a technique which is similar to the technique used during the middle ages with the money they called Bracteats and it only needs a three to five percent cost for the new bills with a new expire date.

Because this money will move on the average faster as the money we use now and which is not only used as medium of exchange but also as a medium for saving the amount of the 5% Tax will be spread over up to 1000 changes of hands in a year. It will practically cost nearly nothing but will still hit with full force the one who keeps money idle for a year.

To avoid any misunderstanding. Money in a bank account is not idle money because other people will borrow it and it is therefor in circulation. The only idle money is money kept in a safe or under the proverbial mattress.

1933 Irving Fisher proposed stamp scrip as a cure for the severe depression which had hit the country at that time. There were quite a few towns which had introduced them on their own and Senators Bankhead and Pettengill brought the Bankhead-Pettengill Bill before the Senate, where they proposed the printing of 1,000,000,000.- Dollars worth of stamp scrip.

Nothing came ever out of it because Irving Fishers stamp scrip was seriously flawed. He had taken the idea from the writings of Silvio Gesell but had not understood the significance of Silvio Gesells idea. Silvio Gesell only wanted to take the superiority away from money which it enjoys against Goods and Services by a yearly tax of 5%. Irving Fisher proposed 104% instead which is twenty times as much. This is as if you say one drink is good for me, so twenty must be much better.

So, off course, Irving Fishers stamp scrip didn't work and the experiments of the different towns folded very soon of their own. I do not know, what devil had ridden him to propose this 104%.

The experiments in Germany and Austria in the opposite from the ones which Irving Fisher had started were a success, because they used a tax of only 12% which is much closer to Gesells original proposal of 5%. But what happened then? Powerful money interests got the government to forbid them and instead of prosperity unemployment and misery came back, followed by Hitler and world-war 2.

John Maynard Keynes, who also learned from Gesell made a different mistake. He thought, that a tax on idle money would not be necessary. He figured that a slight inflation caused by deficit spending would also do the trick. He persuaded the whole world to follow this advice. And yes, it worked for some time and only now to we get to the end of the line where gigantic debts on one side and unearned riches on the other side will force a crash. Although, without him the next cash followed by a war, would have happened within the time frame of 20 to 25 years just as it did after the first world war, as predicted 1919 by Silvio Gesell.

But see, he didn't take the power to strike away from money and therefore we are now on the end of the road and it wont take long (I write this August 1998) until the rich countries will follow the third world countries and Asia into a deep depression.

Now, what can we do? What should we do?

The answer is simple. Follow the original idea of Silvio Gesell! You need a tax on idle money in the amount of only 5% every year and one doesn't even need stamps on the "stamp scrip" or free money as Silvio Gesell called it. To put the tax right on the money, where it belongs, you have only to do the following:

Print free money, which has an expire date on it. The first issue should have expire dates, starting with the first month of the following year on a twelfth of every denomination till the last month of the year. After one year every month some bills will expire and will be exchanged for bills with a new exspiry date a year later. This will cost 5% of the worth of the bill. That is all! And this is the tax on idle money.

Everybody who uses the money for what it is intended, buying goods and services, investing it or put it in a bank, where others can borrow it, escapes this tax and it hits only those who hold it back or hoard it.

Off course, somebody might get stuck with the odd bill on the end of the month but this will only happen once every five hundred times in a year.

You see, free money changes hands about five hundred times a year and it is only taxed once. So the random chance to get a bill, which will expire is six in a thousand. This was proven in Woergl, Austria.

And what do you get for this minimal cost?

1) The people who issue Freemoney can guaranty you the same purchasing power year after year because the have control over the speed of turnover. And you better let them give this in writing. It could actually be written right on the face of the bill beside the exspire date.

2) Because money cannot be held back even when less interest is paid for it interest rates will go down and with that the cost of doing business.

3) Because money cannot be held back, there will be no unsold surplus, neither goods nor labor.(unemployment)

4) In a short time interest rates will drop and the money thus saved will go to labor and not to the idle rich. This, off course, is one of the main reasons, why this free money wasn't introduced a long time ago. This and the fact that very few people know about it and will only listen to their destroyers. Remember, Silvio Gesell offered the knowledge already more than 100 years ago!

Now think! Isn't that a terrific bargain? For a price which is near to nothing you get all this. And you get even more. Think about it! What is the cause of war? Why do the rich always get richer and the poor poorer?

But you see, even the rich do not really profit so much from today's system. Inflation eats their money and deflation eats the profits of their capital investments. They are in a rat race from one into the other and if they guess wrong they lose. And sometimes they get killed by the ones whom they suppressed too long.

Did we forget something? What will happen to all the people who are now busy re-distributing from the slightly richer to the poor, making a living out of it and creaming off more than a third of the money on the way? The really rich can help themselves and never pay any taxes anyway. What will happen to the ones who take money from the poorest of the poor by promising the rewards in the thereafter, when there are no more poor?

These are questions, which you have to answer yourself.

Did we forget something else? Oh, yes! Who shall issue this miracle money? Here we have a problem. In the Thirties it was some towns like here in the States and in Woergl, Austria. In Germany it was just a group of private people. Governments never really got involved. Quite the opposite. Most of them were in the hands of money powers and helped them to put this experiments down.

So the best thing would be to persuade a government, even a local one to issue the money. The next best would be in my opinion a church but it could also work with an ethnic group, especially one living in a kind of ghetto like a reserve. In any case, if started with a big enough diversified market the success of the miracle money would make others want to follow the example just as it happened in Woergl, Austria. Woergl was, after all, only a small town with 4,200 inhabitants and there were villages and towns with altogether more than 100,000 people ready to follow the example.

Only be forewarned. The government might even go so far to use force to suppress this money. So far the Enemy only used subterfuge and mirrors to suppress the knowledge. His tame economists ridiculed Silvio Gesell and his followers but most government are in his hands and when the power of money is seriously challenged by Freemoney, who knows to what lengths they will go.

You cannot even fully trust some of your churches. The Roman Catholic Church, who once didn't allow the taking of interest fell into evil ways hundreds of years ago. At that time, it was the time when they built the beautiful Gothic domes in Europe, they even had a money similar to Free money. They only overdid it with the tax and while they didn't charge as much as Mr. Fisher, their 25% were too much. Especially when they started to-do it twice a year.

After they abandoned this money (called brakteats) the Roman Church really fell to evil ways with the inquisition and it is my guess that they burned as witches most of the people, who wanted the brakteats back.

*) This means, off course, that there has to be an exchange rate to the old money, if that changes its worth either through inflation or through deflation. Remember, Free Money keeps its worth, its purchasing power as measured by an index, which means, that while single prices may change, the average price stand is kept stable.

Milton Friedman ended his excellent Book, Money Mischief, with five conclusions. Here they are:

Conclusions.

Five simple truths embody most of what we know about inflation.

1. Inflation is a monetary phenomenon arising from a more rapid increase in the quantity of money than in output (though, of course, the reasons for the increase of money may be various).

2. In today's world, government determines - or can determine - the quantity of money.

3. There is only one cure for inflation, a slower rate of increase in the quantity of money.

4. It takes time ( measured in years, not months) for inflation to develop; it takes time for inflation to be cured.

5. Unpleasant side-effects of the cure are unavoidable.

Don’t they sound reasonable? On the surface it looks like it and I can find no fault at all with the first three conclusions and we could even let the fourth one stand as it is. There is only a slight misconception in the second part. It would hardly take a long time to cure inflation with the necessary political will. Germany ended inflation from one day to the next twice in this century.

It is only the fifth conclusion at which we will have to take a closer look. Unpleasant side-effects are unavoidable. Yes they are! The question is only, for whom.

Do we want the unpleasant side-effects added to the already unpleasant life of the unemployed? Or do we try to load then unto the people, who get richer by the day with unearned interest income? Are we going to load them on the shoulders of the productive debt-ridden farmers or on the owners of productive enterprises or on the speculators, the banks or the high finance?

To ask this question is to answer it!